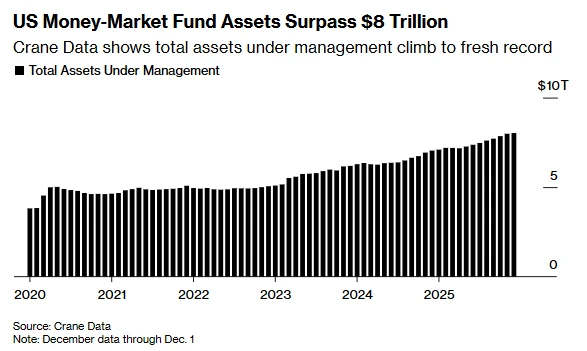

In recent years, thanks to their attractive high returns, US money market funds have become increasingly popular among American investors. And the latest data released by the industry shows that the assets under management of US money market funds have now surpassed the $8 trillion mark, marking another milestone.

According to data from Crane Data, a money market and mutual fund information company, total assets under management in U.S. money market funds increased by approximately $105 billion in the week ending Monday, reaching a record high.

Despite the Federal Reserve's five interest rate cuts since last September, investors continue to flock to money market funds, mainly due to their still relatively high yields compared to other investment instruments.

According to Crane Data, as of December 1, the Crane 100 Money Market Fund Index, which tracks the 100 largest money market funds, still had a seven-day annualized yield of 3.80%.

Federal Reserve policymakers have cut interest rates later this year than many expected at the beginning of the year—the Fed has only lowered the benchmark rate twice so far this year, by 25 basis points in September and October, bringing the target range for the federal funds rate down to 3.75% to 4%.

TD Securities Gennadiy Goldberg, head of U.S. interest rate strategy, said: "With the Fed only cutting rates gradually, money market fund yields remain highly attractive and continue to draw in inflows. We expect inflows to gradually slow as interest rates fall, but historically, annualized yields above 2% should continue to attract inflows."

In November of last year, the assets under management of U.S. money market funds surpassed the $7 trillion mark for the first time, and the seven-day annualized yield of the aforementioned top 100 funds was approximately 4.51%.

Crane data, which tracks the entire money market fund industry, shows that over $848 billion has flowed into money market funds this year. Meanwhile, another set of industry data focusing on this sector—the Investment Company Institute (ICI) weekly data (excluding corporate-owned internal money market funds)—shows that as of the week ending November 25, total assets in money market funds reached $7.57 trillion.

The scale is still expected to continue to climb.

Money market funds are generally more expensive than banks. Passing on interest rate cuts to customers more slowly often attracts more capital inflows.

In addition, during a period of interest rate cuts, institutional and corporate finance executives tend to outsource cash management to generate returns rather than managing it themselves.

Although many industry insiders previously believed that the Fed's rate-cutting cycle would cause trillions of dollars to flow from money market funds to assets such as stocks, it appears that many retail investors are still choosing money market funds, which they consider safer and offer higher returns.

JPMorgan Chase Teresa Ho, head of short-term interest rate strategy at the U.S. Securities and Exchange Commission, points out that retail investors currently allocate about 15%-20% of their portfolios to the money market, which is closer to the historical average. Historically, this proportion reached as high as 40% in 2009.

She stated, "Retail investors' aggressive allocation to the money market is not beyond a reasonable range and does not require proactive adjustment. Therefore, I believe that after the market size surpasses the $8 trillion mark, it will continue to climb next year."

(Article source: CLS)