Cryptocurrency prices are entering a downward trend; for example, Bitcoin has fallen by as much as 25% in the past two months, causing widespread concern in the market.

The overall market weakness amplified the risks associated with memes, with tokens linked to the Trump family experiencing the most significant price drops. WLFI, the token of World Freedom Finance, founded by Trump and his family, has fallen 51% since its early September peak, while memes named after Trump and his wife Melania have fallen 90% and 99% respectively from their January highs.

In addition, the stock price of U.S. Bitcoin Company, founded by Trump's eldest son Eric, plummeted by about 39% on Tuesday, and has fallen by 76% from its September high. The stock price of Alt5 Sigma, a partner of World Freedom Financial, has also fallen by about 75% from its high.

Data shows that the recent cryptocurrency downturn has shrunk the Trump family's wealth by more than $1 billion, but the family's wealth is still considerable.

The Unpredictable Trump

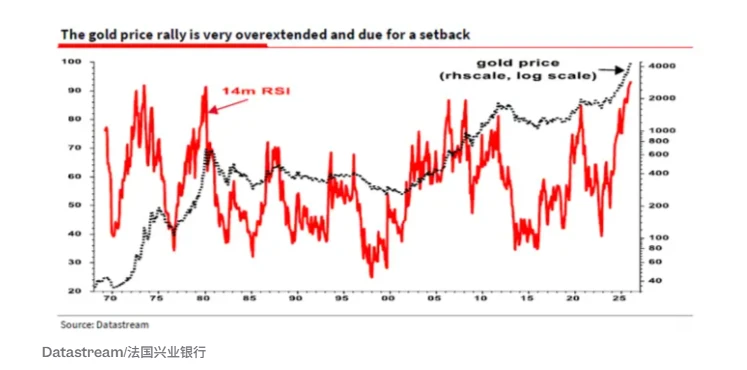

The widespread decline in cryptocurrencies reflects the industry's persistent cyclical nature. Previously, crypto investors touted the Trump administration's pro-crypto policies as a driving force for continued growth, but speculators are now forced to reassess market dynamics.

Bitcoin has a so-called "four-year cycle," during which its price often reaches a peak after a halving, followed by a significant pullback.

Hilary Allen, a law professor at Washington College of Law, points out that Trump's presidency is a double-edged sword for the legitimacy of cryptocurrencies. He attempted to endorse the legitimacy of cryptocurrencies by launching his own cryptocurrency projects, but this did not work, and many projects have rapidly depreciated.

This is also directly related to the unpredictability of the Trump administration's policies. Following the crypto dinner in April, entrepreneur Joel Li, who attended, quickly sold his Trumpcoin holdings, which he considered his entry ticket. He revealed that the Trump administration's tariff offensive worsened the situation, and people began to realize the huge gap between appearances and reality.

Crypto investor Michael Terpin further stated that the US government's tariff policies serve as a reminder to the market that Trump offers opportunities, but he will also take them away. In short, it's difficult for investors to gain certainty from Trump's current policies.

Meanwhile, some cryptocurrency companies associated with Trump are also facing financial risks. Last week, Alt5 Sigma announced that it had dismissed some senior management members due to long-standing legal issues.

This week, Nasdaq The stock exchange has officially notified Alt5 Sigma that it has been placed on a non-compliance list due to its failure to submit its Q3 2025 financial report on time, thus no longer meeting the requirements for continued listing. The company stated that this notification was expected, and the reasons for the delayed submission included changes in auditors, corporate governance issues, and the former CEO's declaration of personal bankruptcy.

(Article source: CLS)