US Stock Market: All three major US stock indexes closed higher on December 3. At the close, the Dow Jones Industrial Average rose 408.44 points to 47,882.9, a gain of 0.86%. The S&P 500... The S&P 500 index rose 20.35 points to close at 6849.72, a gain of 0.3%; the Nasdaq ... The composite index rose 40.42 points to close at 23,454.09, a gain of 0.17%.

Major tech stocks were mixed, with Tesla among the top performers. Google and TSMC rose more than 4%. AMD rose more than 1%, Microsoft Meta and Nvidia fell more than 2%. Apple fell more than 1%. It fell by 0.71%.

robot Stocks related to robotics surged, with Nauticus Robotics jumping over 115%, iRobot rising over 73%, and Serve Robotics climbing over 18%. Reports indicate that the Trump administration, after heavily investing in AI, is shifting its focus to robotics . (Non-ferrous metals ) Cryptocurrency reserve concept stocks rose, with Alcoa leading the gains. The company's stock rose more than 6%, along with Coinbase and Caesar Aluminum. Stocks rose over 5%, with Strategy gaining over 3%. Storage and lithium mining stocks declined, with SanDisk falling over 5%, and Lithium and Micron Technology also declining. Western Digital It fell by more than 2%.

Most popular Chinese concept stocks fell, with the Nasdaq China Golden Dragon Index closing down 1.38%. NIO... XPeng Motors Li Auto fell more than 4%. New Oriental Bilibili fell more than 3%. Miniso Alibaba fell more than 2%. Baidu Pinduoduo Century Internet fell by more than 1%. It rose by more than 1%.

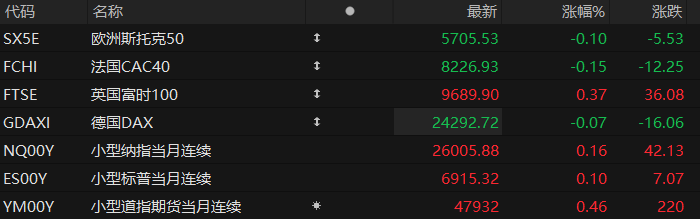

European stock markets: The three major European stock indices closed mixed on December 3rd. The FTSE 100 index in London closed at 9692.07 points, down 9.73 points, or 0.1%, from the previous trading day; the CAC 40 index in Paris closed at 8087.42 points, up 12.81 points, or 0.16%, from the previous trading day; and the DAX index in Frankfurt closed at 23693.71 points, down 17.15 points, or 0.07%, from the previous trading day.

Commodity Markets: International oil prices rose on December 3. At the close of trading that day, the WTI crude oil futures contract for the current month on the New York Mercantile Exchange rose $0.47 to settle at $59.11 per barrel, a gain of 0.80%. The COMEX gold futures contract for the current month rose $14.00, a gain of 0.33%, to $4234.8 per ounce.

Overnight news

US robotics stocks rallied across the board, reportedly as the US government is preparing to invest in this field.

Reports indicate that the Trump administration is preparing to accelerate the development of robotics technology. Three sources revealed that Commerce Secretary Rutnick has recently been meeting with several CEOs in the robotics industry. Two other sources indicated that the U.S. government is considering issuing an executive order on robotics technology next year. A spokesperson for the U.S. Department of Commerce responded, "We are committed to promoting robotics and advanced manufacturing because they are central to bringing critical production back to the United States."

US ADP employment report shows the largest drop in two and a half years, with small businesses being the hardest hit by the employment winter.

The latest ADP nonfarm payrolls report unexpectedly reversed course and showed a significant decline, reflecting a weaker-than-expected US job market. This occurred before the US stock market opened on Wednesday (December 3rd). Data released by ADP shows that the private sector lost 32,000 jobs in November. The last time such a decline occurred was in March 2023. The market had expected an increase of 10,000 jobs, and October saw an increase of 47,000.

Bank of America: New Chairman Unlikely to Shake Fed Independence; Powell's Retention on Board May Be a Key Variable

Bank of America Analysts believe that even if President Trump appoints a new Federal Reserve chairman, it will not be enough to threaten the Fed's independence, especially given that current Fed Chairman Jerome Powell has chosen to remain on the board. Since his second term, Trump has repeatedly pressured Powell and the Fed to cut interest rates, but the latter has consistently adhered to its established monetary policy plan. Trump once threatened to dismiss Powell, but given the potential impact on financial markets, the threat ultimately fell through.

White House official: The US and Russia held a deep and productive meeting.

On December 3, local time, White House officials stated that the US and Russia held in-depth and productive talks. Following their meeting with Russian President Vladimir Putin on December 2, US special envoys Witkov and Kushner briefed US President Donald Trump. On December 2, local time, Russian President Vladimir Putin held talks with US special envoy Witkov and Trump's son-in-law Kushner, who were visiting Moscow, regarding a "peace plan." Dmitriev, CEO of the Russian Direct Investment Fund, who participated in the talks, posted on social media after the talks concluded in the early hours of December 3, Moscow time, stating that the talks with US special envoys Witkov and Kushner were "productive." Russian Presidential Press Secretary Dmitry Peskov previously stated that the talks between Putin and Witkov in Moscow were an important step towards a peaceful resolution to the Ukraine crisis—Russia hopes that the US's efficient mediation will be successful, and Russia is willing to make efforts to achieve peace.

AI is too lucrative! Micron announces "difficult decision": exiting the retail storage business.

Amidst the recent surge in memory module prices, memory chips... Manufacturer Micron Technology has abruptly announced the closure of its retail channel business to focus on competing in the advanced memory chip market for the AI era. In a statement released Wednesday, Micron announced its exit from the Crucial consumer business, with existing inventory to be sold until the end of the second quarter of this fiscal year (February 2026). The company will continue to supply Micron-branded enterprise products to global commercial channel customers, and existing product warranties will remain unaffected.

The US launches "Trump Accounts" for newborns: investments in US stocks can be withdrawn after age 18! Dell founder donates $6.2 billion to "fund" 25 million children.

Trump has made another big move. According to Red Star News, on the 2nd local time, the White House announced that it will open "Trump accounts" for American children under the age of 18, and babies born between 2025 and 2028 will receive an additional $1,000 injection from the U.S. Treasury Department.

Apple's top designer joins Meta! Silicon Valley's AI hardware war intensifies.

Renowned tech leaker Mark Gurman revealed on Wednesday that Alan Dye, Apple 's most prominent current design executive, is leaving to join Meta. This move not only demonstrates Meta's focus on "AI consumer electronics"... Apple 's ambitions in the "market" have also perpetuated the trend of losing top design talent.

The World Bank warns that developing countries are "not out of danger" as their debt gap rises to its highest level in 50 years.

World Bank The World Bank said on Wednesday that the gap between external debt servicings and new financing for developing countries will reach $741 billion between 2022 and 2024, the highest level in more than 50 years. The institution urged countries to take advantage of the current relatively loose global financing environment to improve their fiscal situation. In its annual International Debt Report, the Washington-based lender noted that despite some easing from declining global interest rates, total interest payments for developing countries will still reach a record $415.4 billion in 2024. Total external debt also reached a record $8.9 trillion last year.

Shares of the "European version of Starlink" plunge; SoftBank's halving of its stake tests Europe's dream of technological sovereignty.

Shares of French satellite communications operator Eutelsat plummeted on Wednesday (December 3) after news broke that SoftBank had significantly reduced its stake in the company.

The EU will impose a complete ban on imports of Russian natural gas in the fall of 2027.

The European Council announced on its website on March 3 that the EU will impose a complete ban on imports of Russian natural gas starting in the autumn of 2027. Reports indicate that representatives of the European Council and the European Parliament have reached an agreement to gradually and eventually completely ban imports of Russian natural gas . The agreement stipulates that the ban on Russian liquefied natural gas (LNG) imports will take effect at the end of 2026, and the ban on pipeline natural gas imports will take effect in the autumn of 2027.

Copper prices surge across the board, hitting record highs as US funds aggressively hoard copper.

At this crucial juncture in the 2026 copper smelting processing fee negotiations, amid tight copper mine supply, the competition in the copper market is intensifying. On December 3rd, copper prices on the London Metal Exchange (LME) hit a new historical high, with exchange data showing the largest single-day increase in delivery orders since 2013. The Shanghai copper futures main contract also broke through the 90,000 yuan/ton mark, reaching a new historical high.

Glencore boldly declares it will become the "world's copper king," with its production capacity decline expected to bottom out next year.

As international copper prices hit a new record high on Wednesday, mining giant Glencore announced plans to double its copper production over the next 10 years. At its first Capital Markets Day event in three years, Glencore CEO Gary Nagle outlined the company's plans to become the "world's largest copper producer," aiming for an annual output of 1.6 million tonnes by 2035.

Disclaimer: This article is generated by AI and is for reference only. It does not constitute any investment advice, and any actions taken based on it are at your own risk.

(Article source: Eastmoney) Research Center