According to media reports, the Trump administration canceled the final interviews scheduled for Wednesday with the Federal Reserve Chair nominees. Following a significant signal from the US president the previous day, current White House National Economic Council Director Kevin Hassett has become the frontrunner for the new Fed Chair position and a key figure in Trump's "restructuring" of the Fed. However, the challenges he faces remain formidable due to the uncertainty surrounding the macroeconomic situation.

Is the outcome already decided?

According to sources familiar with the matter, the Trump team has informed the candidate that the scheduled interview with Vice President JD Vance on Wednesday has been canceled, without explaining the reason for the decision.

Trump said on Tuesday that he will announce his successor to Jerome Powell as Federal Reserve chairman early next year. “I think there’s a potential Fed chairman here today. Can I say that? It’s ‘potential.’ What I can tell you is that he’s a very respected person,” Trump said at a White House event.

Hassett, 63, served as chairman of the Council of Economic Advisers during Trump's first term and is now a key economic advisor to the government. He supports Trump's large-scale import tariffs and endorses his calls for lower interest rates through occasional appearances on channels such as CNBC and Fox News. Furthermore, Hassett's office is located in the West Wing of the White House, meaning he has direct access to Trump and has influenced Trump's views on trade, economic issues, and monetary policy.

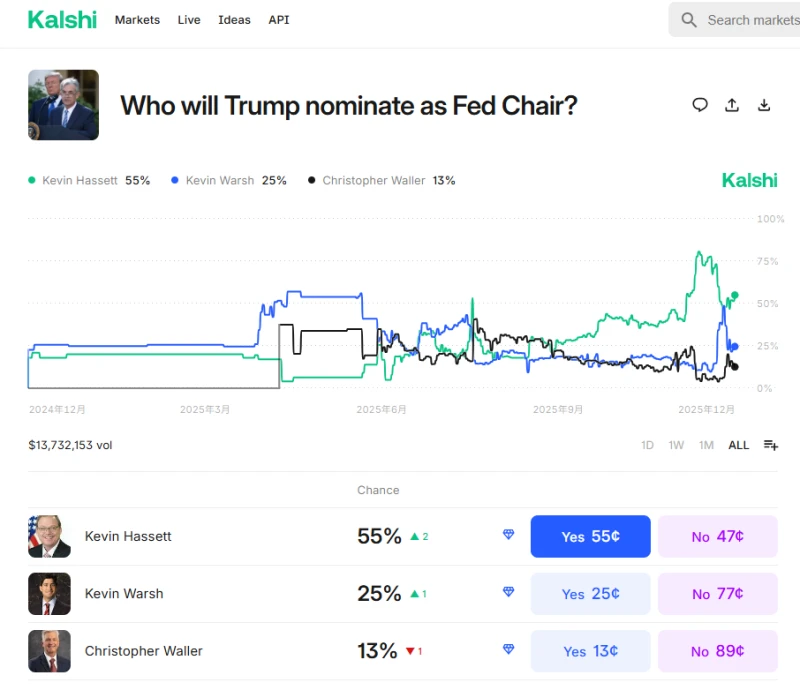

As of December 3, according to Kalshi's market forecast data, Hassett has a greater than 80% chance of becoming the next Federal Reserve Chairman.

Powell's decision

If Hassett becomes the new chairman of the Federal Reserve, he will shoulder the heavy responsibility of reorganizing the Fed under Trump's leadership.

Besides Powell, three members of the Federal Reserve Board of Governors were appointed by former President Biden, while the remaining three were appointed by Trump. The most recent appointee is Stephen Miran. If Powell does not resign after his term ends, or if Trump fails to remove Lisa Cook, the Fed Governor appointed by Biden, Miran will have to resign to make way for a new candidate for Fed Chair.

Former Federal Reserve Governor Kevin Warsh is Hassett's main rival for the position of Federal Reserve Chairman. He has publicly criticized the Fed's current structure. Even if he fails to become chairman, market observers still expect him to join the Federal Reserve Board of Governors, helping to push for comprehensive reforms in the Fed's approach to economic growth and inflation control. A leadership team centered around Hassett, Warsh, and Fed Governors Chris Waller and Michelle Bowman would constitute one of the most accommodative voting blocs within the Fed in decades.

Therefore, Powell's decision has attracted attention. If he announces that he will relinquish his remaining term as a Federal Reserve governor, it will create another vacant position for the government on the Federal Reserve Board, thereby further expanding Trump's influence. Traditionally, Federal Reserve chairpersons can continue to serve as governors after their term ends. However, Powell's predecessor, Yellen, chose to resign from her governorship at the end of 2017, becoming the first Federal Reserve chairperson since the 1970s to not be re-elected and voluntarily relinquish her remaining term.

A report released by LH Meyer, a research firm led by former Federal Reserve Governor Larry Meyer, suggests that Powell will remain on the Federal Reserve Board of Governors after stepping down as Fed chairman to buffer against Trump's attempts to exert control over the central bank. "After Trump's attempt to fire Cook, Powell is now likely more convinced of the necessity to do so (remain on the Board)."

Also of concern is the continued uncertainty surrounding the positions of the remaining 10 members of the Federal Open Market Committee (FOMC), meaning the new chair will face the challenge of "building consensus." Internal divisions within the committee could exacerbate market volatility and raise questions about the stability of the Federal Reserve.

A survey by CBN reporters found that regional Federal Reserve presidents are the primary source of opposition to further interest rate cuts. Since September, one regional Fed president has voted against a rate cut, and two other regional Fed presidents with voting rights on monetary policy this year have also hinted that they might oppose a third rate cut next week.

How will the capital market react?

Wall Street analysts believe that Hassett's nomination could immediately drive a bull market in risk assets. However, if Powell does not announce his withdrawal from the Federal Reserve Board of Governors within weeks of the nomination announcement, investors may become uneasy—his continued tenure could hinder the progress of subsequent appointments.

Furthermore, as the positive effects gradually dissipate, this optimism may wane before the new Federal Reserve Chairman chairs the first FOMC meeting in June 2026. At that time, traders will focus on the level of internal unity within the new committee.

Federal funds rate futures pricing indicates that the current market median forecast for the December 2026 interest rate is approximately 3.02%, but given Hassett's policy stance, the neutral rate may actually be much lower than this. His public statements suggest that once inflation is contained, a reasonable policy rate should be between 2% and 2.5%. In contrast, Trump has repeatedly stated this year that he hopes US interest rates will be below 1%.

It's worth noting that the median of the Federal Reserve's "dot plot" is somewhat misleading because it includes forecasts from non-voting members. If outgoing policymakers are excluded and the positions of Hassett and Walsh are included, the adjusted median interest rate forecast is approximately 2.6%, lower than current levels.

"Regardless of who leads the Federal Reserve...monetary policy is determined by economic conditions." - BNP Paribas James Egelhof, the bank’s chief U.S. economist, said in a conference call during the bank’s 2026 economic outlook report.

The outlook report indicates that the US economy is expected to maintain resilient growth, and inflation will persist. Therefore, after the Federal Reserve is expected to implement one rate cut in December, only one more rate cut is likely next year. At that time, the new Fed chairman appointed by Trump will keep borrowing costs unchanged, given that inflation is stable at 3%. "The data will indicate that, apart from the rate cuts we expect to implement, there will be virtually no need for further aggressive rate cuts," Eggerhoff explained.

According to a survey released early last month by the National Association for Business Economics (NABE), the U.S. economy is projected to experience moderate growth in 2026. The survey indicates a median growth rate of 2%, up from 1.8% in the October survey. Economic growth is expected to be supported by stronger consumer spending and business investment, but new import tariffs imposed by the Trump administration could reduce growth by 0.25 percentage points or more.

The National Association for the Study of Economic Research (NABE) currently projects that inflation will only slightly decline to 2.6% by 2026. Economists believe that tariffs are driving up inflation . One of the key factors contributing to inflation. Job growth is expected to remain weak, with the unemployment rate rising to 4.5% in early 2026 and remaining at that level throughout the year.

(Article source: CBN)