Bitcoin's price has been volatile at the end of the year, with a bear market atmosphere prevailing. However, according to JPMorgan Chase... According to JPMorgan, there is no need to worry at present, and it is expected that Bitcoin may rise by 84% in the next 6 to 12 months, based on its model predicting that Bitcoin's trading trend will be similar to that of gold.

A team of strategists led by Nikolaos Panigirtzoglou wrote in a recent client report: "Our volatility-adjusted Bitcoin vs. Gold ratio still suggests that Bitcoin's theoretical price is near $170,000, indicating significant upside potential over the next 6-12 months. "

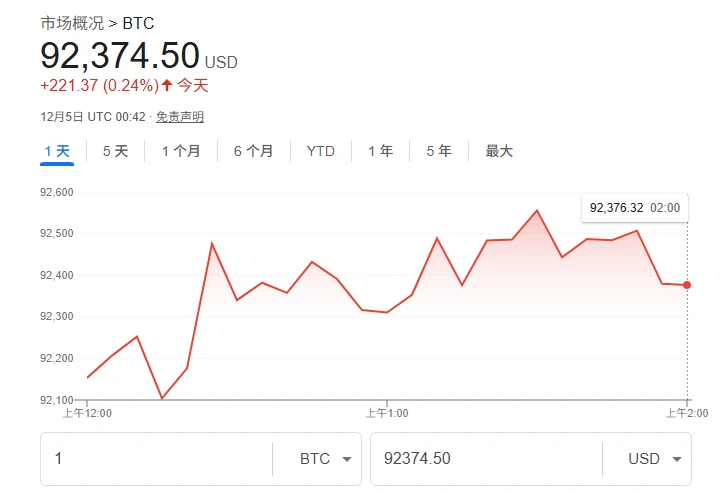

As the leading cryptocurrency, the past few months have undoubtedly been tough for Bitcoin. As of press time, Bitcoin is trading at $92,374.5, down approximately 36% from its all-time high of over $126,000 earlier this year.

However, JPMorgan Chase has long believed that Bitcoin's trading methods may become more similar to those of gold. This was most evident in April of this year, when concerns about tariffs triggered a historic sell-off in U.S. stocks, leading to an influx of funds into Bitcoin and other cryptocurrencies.

The bank's strategists also stated that they are monitoring two factors that could influence Bitcoin's price in the short term: 1. The possibility of Strategy selling Bitcoin.

Concerns are rising that Strategy Inc., known globally for its early bets on Bitcoin, may be selling off its holdings. Crypto analytics firm Arkham Intel estimates that Strategy held approximately 437,000 Bitcoins in November, down from a peak of around 484,000 earlier in the month.

Strategy CEO Phong Le previously stated that if its mNAV (market capitalization multiple: company market capitalization / net asset value of crypto assets) falls below the threshold of 1, the company may eventually sell its Bitcoin. A price-to-book ratio of 1 for Strategy means that its share price is no longer trading at a premium to the value of Bitcoin.

The latest data on the company's website shows that the metric is hovering around 1.1.

In addition, the company's executive chairman, Michael Saylor, has stopped advocating for holding Bitcoin firmly and has changed his tune, saying that Strategy may sell some of its Bitcoin holdings.

However, JPMorgan strategists pointed out that the company recently announced it had raised $1.4 billion in cash reserves. Strategists estimate this is enough to cover dividends and interest for about two years without the company selling Bitcoin. They added that with this reserve, the likelihood of a forced sale is "lower."

“If this ratio stays above 1.0, MicroStrategy can eventually avoid a Bitcoin sell-off, the market may be reassured, and the worst period for Bitcoin prices may be over,” they added.

2. MSCI's decision

In January, financial index provider MSCI will decide whether to exclude companies with 50% or more of their assets invested in digital assets from its indices. The reason given is their concern that these companies resemble investment funds, which are currently ineligible for inclusion in MSCI indices.

JPMorgan Chase previously estimated that if this rule is implemented, Strategy will be removed from the MSCI US Index and the MSCI World Index, which could result in an outflow of approximately $2.8 billion from the stock.

The bank wrote, "On the other hand, if MSCI's final decision is positive, then both Strategy and Bitcoin could see a strong rebound to levels seen before October 10th. This suggests that in this scenario, cryptocurrencies could potentially return to all-time highs."

(Article source: CLS)