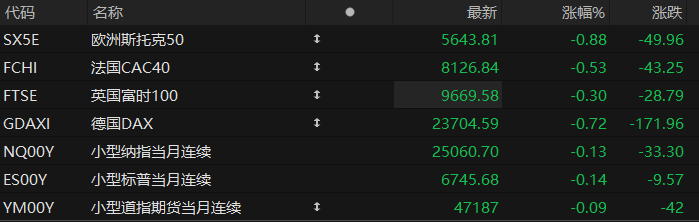

BlackRock, the world's largest asset management company AI is expected to continue dominating the market in 2026, and investors are anticipated to face more volatile market conditions – speculative trading and leveraged operations are driving up risks, potentially repeating the sharp sell-off of last month…

Helen Jewell, BlackRock's chief investment officer for fundamental equities in Europe, the Middle East, and Africa, said on Thursday that artificial intelligence... The returns on related investments will continue to rise, but some periodic doubts about industry valuations or prospects may lead to increased stock volatility.

"Do I expect the returns on AI growth to be on the rise? Yes, these staggering capital expenditures are being driven by companies with huge amounts of cash," Jewell said in an interview on the sidelines of a conference in London.

"Do I think this journey could be bumpy? Absolutely." She pointed out that crowded trades and leveraged trading are key factors in market volatility.

Last month, the market reacted to the news that artificial intelligence companies were rushing to build new data centers. Concerns about overspending once triggered the most severe correction in the US stock market in months.

Currently, hedge funds are trading at leverage levels close to historical peaks. However, if asset prices fall, forcing them to liquidate positions to meet lender requirements, the market could clearly face the risk of a rapid and sharp short-term sell-off.

Other viewpoints

In an interview that day, Jewell also said that she is currently increasing her holdings in European energy and power infrastructure stocks, such as Siemens Energy, as the artificial intelligence boom and the surge in demand for new data centers are driving demand for turbines, grid technologies and clean energy.

In another panel discussion, Jewell stated that BlackRock remains optimistic about defense stocks, but not as bullish as it was at the beginning of the year.

European aerospace and defense stocks fell 8% in November, marking their biggest monthly drop since June 2024, fueled by speculation surrounding a potential peace agreement between Ukraine and Russia.

(Article source: CLS)