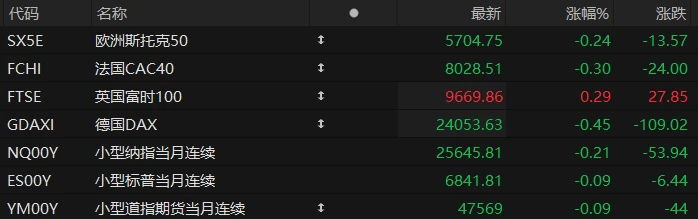

U.S. stock index futures fell across the board in pre-market trading on Wednesday, while most major European indices also declined. As of press time, the Nasdaq... S&P 500 futures fell 0.21%, S&P 500 futures fell 0.09%, and Dow Jones futures fell 0.09%.

In terms of individual stocks, major US tech stocks were mixed in pre-market trading, with Nvidia showing mixed performance. Tesla Amazon , apple Microsoft shares rose slightly in pre-market trading. It fell nearly 2% in pre-market trading, and Meta fell nearly 1%.

Space concept stocks rose collectively in pre-market trading, with DXYZ up nearly 10% and EchoStar Communications also gaining ground. Shares rose nearly 5%; news that SpaceX is reportedly seeking an IPO next year boosted the stock prices of space companies across the board.

Game Station The stock fell more than 6% in pre-market trading after the company released its Q3 financial report, showing a net profit of $77.1 million and sales of $821 million in the third quarter.

Popular Chinese concept stocks showed mixed performance in pre-market trading, with Baidu... Alibaba rose more than 2%. Pinduoduo rose nearly 1%; Bilibili fell more than 3%. Li Auto It fell by more than 1%.

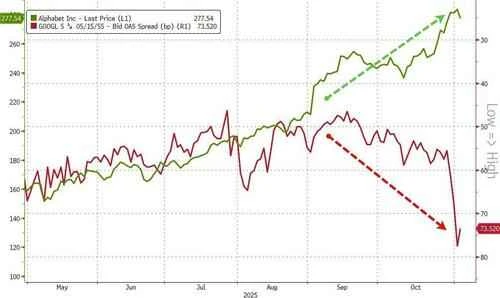

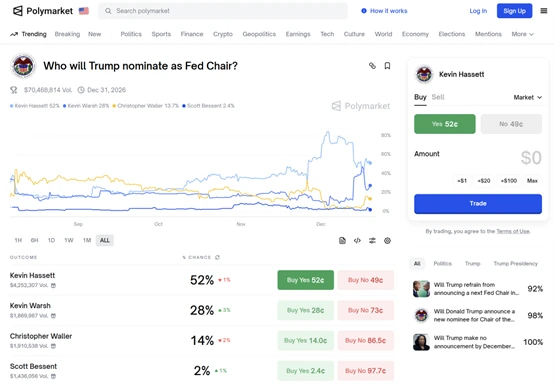

The Federal Reserve is set to announce its latest interest rate decision at 3:00 AM Beijing time on Thursday. After a period of apparent hesitation regarding the Fed's decision, the market is now largely convinced that the Fed will cut interest rates for the third consecutive time by 25 basis points, bringing the federal funds rate down to 3.5%-3.75%.

But the situation is not so simple. The Federal Open Market Committee (FOMC) of the Federal Reserve is experiencing serious internal divisions. Some members support rate cuts to prevent further weakness in the labor market, while others believe that easing is already sufficient and that further rate cuts could exacerbate inflation.

This is why "hawkish rate cut" has become a popular phrase at this policy meeting. In market terms, this means that while the Federal Reserve will cut rates, it is also sending a signal that no one expects the next rate cut to come anytime soon.

Hot News

As Wall Street celebrates 2026, Deutsche Bank raises a "terrifying" question: What if the Federal Reserve raises interest rates next year?

As the year draws to a close, major Wall Street investment banks have given optimistic forecasts for the US stock market next year, predicting that the S&P 500 index will continue its upward trend next year, building on the significant gains it has already made this year.

In their analysis reports, major investment banks almost unanimously mentioned a key supporting factor for US stocks: the Federal Reserve is expected to continue cutting interest rates next year. However, Deutsche Bank... Analysts warn that their Wall Street counterparts may be overlooking a fatal risk—the Federal Reserve may not necessarily cut interest rates next year, and could even raise them instead.

In a report, Deutsche Bank analyst Jim Reid warned that the market's bets on a Federal Reserve rate cut next year may be a bit too optimistic, because traditional policy rules and the impending fiscal turmoil brought about by Trump's "Big and Beautiful Act" will leave little room for the Fed to further ease monetary policy, and instead increase the risk of the next rate hike.

Although the Federal Reserve is still on the path of interest rate cuts and is expected to cut rates by another 25 basis points at its meeting early Thursday morning Beijing time, Deutsche Bank's analysis based on various macroeconomic models concludes that, given that US inflation expectations will remain above target and the Trump administration's massive fiscal stimulus is about to be rolled out, the Fed's interest rates have actually been pushed to the lower end of the appropriate range.

After spot silver prices broke through $60, the momentum continued, with ETF funds pouring in and speculators gathering.

After breaking through $60 per ounce in a historic move overnight, spot silver prices continued to rise on Wednesday (December 10).

Specifically, spot silver prices reached $61.62 per ounce during Wednesday's European session, with a daily increase of over 1.3%. Silver prices have risen nearly 9% this month, potentially marking their eighth consecutive month of gains, and have risen over 112% year-to-date.

Analysts believe that the recent surge in silver prices is primarily driven by tight supply and speculative funds betting that the Federal Reserve will further ease monetary policy at Wednesday's interest rate decision. Lower borrowing costs typically benefit non-yielding precious metals like these. .

Currently, the market expects the Federal Reserve to lower policy rates again, as it did in September and October. The CME Group's FedWatch tool shows that the market expects an 87.6% probability of a 25 basis point rate cut, and only a 12.4% probability of keeping rates unchanged.

BNP Paribas David Wilson, head of commodities strategy, said, "Silver has a large base of retail and speculative investors, and once it gains upward momentum, it tends to attract more money into the market."

Musk regrets it: If he could do it all over again, he would never lead the U.S. Department of Government Efficiency again!

As the CEO of Tesla and SpaceX, Musk enjoyed immense success in the business world for the past two years.

However, this year, after US President Trump took office and appointed Musk as the head of DOGE, Musk, who stepped into the American political circle, has encountered setbacks on both sides: on the one hand, after going to great lengths to cut a large number of so-called "redundant" departments and personnel, DOGE's achievements in saving taxpayers' money are still "limited"; on the other hand, Musk's own Tesla Motors company once experienced a sharp drop in stock price.

After months of high-profile layoffs, DOGE has quietly dissolved. Scott Cooper, the U.S. Office of Personnel Management, revealed earlier this month that the DOGE office had been dissolved ahead of schedule, even though there were still eight months left in its original term.

In an interview on Tuesday, Eastern Time, Musk reflected on this experience, stating bluntly that if given the choice again, he would not lead DOGE . He also remarked that the experience was somewhat "dazed": Musk stated that the name "DOGE" was coined "based on suggestions online." While he still believes that efforts to reduce government spending are worthwhile, he also acknowledged that his efforts during his months working with the Trump administration were not very effective.

US Stocks Focus

Amazon deepens its presence in the Indian market: Investing $35 billion in India by 2030.

US tech giant Amazon said Wednesday (December 10) that it plans to invest more than $35 billion in India by 2030 to expand its business and enhance local artificial intelligence. This capability makes Amazon the latest global technology company to deepen its business presence in the world's most populous country.

It is understood that this new investment will focus on business expansion and three strategic pillars: AI- driven digital transformation, export growth, and job creation.

The company plans to create an additional 1 million direct, indirect, derivative, and seasonal jobs in the Indian market by 2030.

Amazon stated that this investment aims to further solidify its position in India, Asia's third-largest economy. The company has invested nearly $40 billion in its Indian operations since 2010, further expanding its influence in the country to compete with Walmart in the retail and e-commerce sectors. It competes with Flipkart, India's largest integrated e-commerce platform, and the retail division of Reliance Industries, a subsidiary of Ambani.

Amazon also noted that it has helped Indian sellers achieve more than $20 billion in cumulative exports over the past decade and now plans to increase that figure to $80 billion by 2030, a fourfold increase.

Netflix Is the acquisition in jeopardy? Paramount's CEO is reportedly personally lobbying Warner shareholders to snatch the deal.

According to sources, Paramount Skydance CEO David Ellison met with Warner Bros. Discovery in New York on Tuesday. Ellison tried to persuade the investors to abandon Netflix 's takeover offer.

Last Friday, streaming giant Netflix announced an agreement with the board of directors of veteran film studio Warner Bros. Discovery to acquire the latter for $27.75 per share. However, Paramount Skydance announced a hostile takeover bid for Warner Bros. Discovery this Monday, offering $30 per share. Paramount's offer involves acquiring shares directly from existing shareholders, bypassing the Warner Bros. board.

Mario Gabelli, a veteran media investor and fund manager who attended Tuesday's meeting, said, "They...did an exceptionally good job of answering questions at the regulatory, state, and global levels, especially regarding the differences between Netflix and Paramount."

Based on Tuesday's share price, Gabelli's fund holds approximately $160 million worth of Warner Bros. Discovery stock. Gabelli stated, "If Netflix doesn't change its offer structure, my clients... would have benefited more from accepting Paramount's takeover offer."

He added that from a regulatory perspective, Paramount's bid was "less complicated" and therefore could be completed more quickly, "Netflix has to raise its bid."

Even with better-than-expected earnings, Oracle It remains difficult to dispel concerns about debt and the risks of AI transactions.

Oracle will release its second-quarter earnings report on Wednesday (early Thursday morning Beijing time). Analysts point out that regardless of the performance, market concerns about its high debt, persistently negative free cash flow, and the feasibility of its collaboration with OpenAI will be difficult to dispel.

Since hitting a record high on September 10, Oracle's stock price has fallen by 33%, reflecting a more cautious market attitude towards AI-related companies. Several technology companies, including Oracle, are facing a test of investor confidence due to aggressive capital expenditures and the risks associated with recurring transactions in business partnerships.

Currently, the company's five-year credit default swap pricing has risen to a record high, becoming an important tool for the market to hedge credit risk in the AI sector. Analysts generally believe that this uncertainty may overshadow any potential positive signals in the financial statements.

Gabelli Funds analyst Ryuta Makino emphasized, "The core issue lies in customer concentration and the corresponding financing structure. With continued investment in data centers..." Its free cash flow is likely to remain under pressure in the coming years.

(Article source: Hafu Securities) )