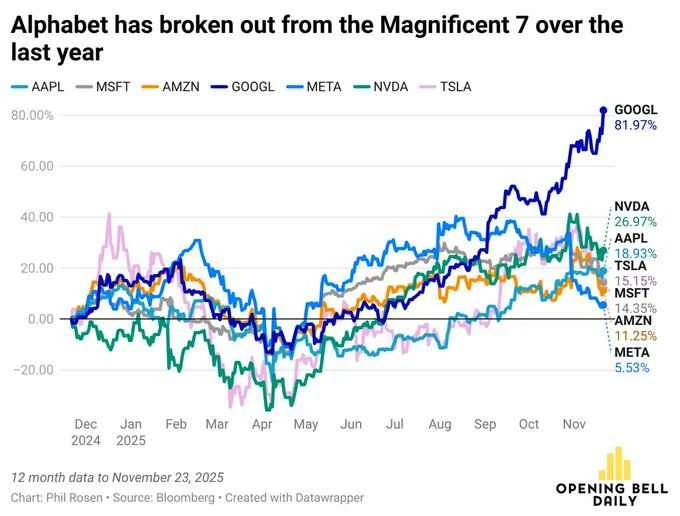

In artificial intelligence Against the backdrop of the continued booming development of (AI), the global semiconductor industry... The market is rapidly approaching the historic trillion-dollar milestone. Both Wall Street tycoons and retail investors are closely watching the "winners" of this wave.

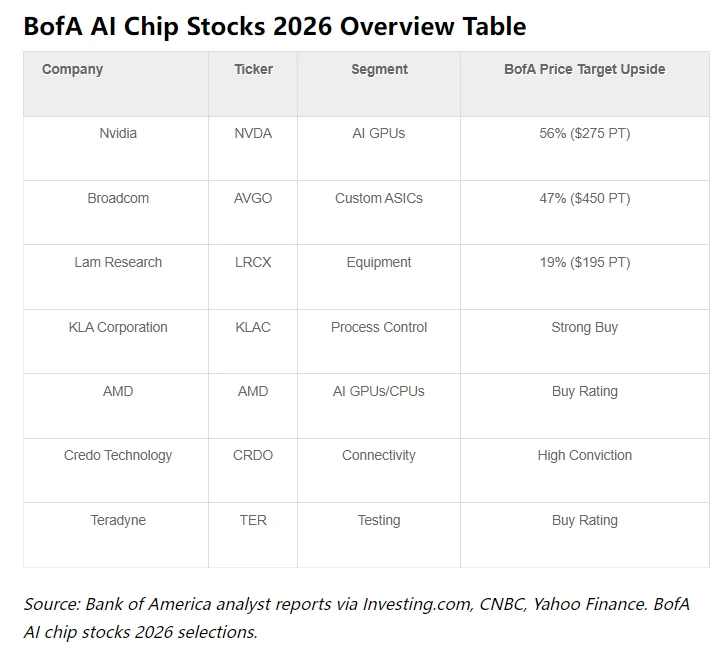

In its latest outlook report, Bank of America It listed seven AI chip companies that it believes have a promising future in 2026. Among them is Nvidia . Broadcom AMD and others were specifically named "top picks" by the bank, which anticipates they will be among the top 1 trillion dollars in AI chip stocks. Benefit from the market.

Bank of America analysts, led by Vivek Arya, wrote: " We are currently only halfway through a decade-long transformation. Despite anticipated volatility, we remain bullish on semiconductor , memory, and semiconductor equipment stocks related to artificial intelligence ."

"This week's CES show may focus on physics ( robotics). " In the fields of cutting-edge artificial intelligence (device-side) and continuous cloud computing "In terms of construction, it will bring new growth opportunities," the report stated.

Arya predicts that global semiconductor sales are expected to grow by approximately 30% year-on-year by 2026, ultimately pushing the industry's annual sales past the $1 trillion mark. The report states, "This is not incremental growth, but a fundamental shift in how global computing power is consumed."

In fact, the timing of Bank of America's release of this report is crucial: in the third quarter of 2025 alone, Microsoft... Amazon Alphabet, Meta, and three other companies have collectively invested nearly $110 billion in AI-driven capital expenditures. Warnings of an "AI bubble" are growing louder in the market as a result.

Bank of America, however, believes this is not speculative spending, but rather infrastructure investment needed for the semiconductor industry over the next few years. Arya projects capital expenditures of approximately $600 billion this year, with artificial intelligence remaining a dominant theme, although its utilization has become a focus for investors.

However, he also cautioned that although the United States has top-tier hyperscale data centers... The free cash flow of carriers (including Amazon , Google, and Microsoft ) may alleviate some concerns, but the industry may still face scrutiny.

Bank of America's Choice

In the aforementioned report, Bank of America listed seven companies in the semiconductor supply chain that they favor (see table below), believing they offer the best risk-reward ratio until the end of 2026. These AI chip stocks encompass GPU designers, chip manufacturers, semiconductor equipment suppliers, and specialized connectivity service providers.

Nvidia rightfully tops this list. Arya stated that Nvidia has taken a completely different approach compared to traditional chipmakers. Bank of America has given a target price of $275 and emphasized that Nvidia is the cornerstone of any artificial intelligence investment portfolio.

The report states, "While a typical semiconductor chip costs around $2.40, an Nvidia GPU can cost as much as $30,000. This pricing power reflects Nvidia's 70-75% market share in the AI accelerator field."

Arya also pointed out that Nvidia's current price-to-earnings ratio (based on fiscal year 2026/2027 projections) of 24x/18x is quite attractive, representing about half of its growth rate. Factors driving subsequent stock price increases include CES and GTC conferences, as well as the ongoing rollout of the Blackwell architecture, which has already generated record data center revenue.

As for its other "top pick," Bank of America chose Broadcom and set a target price of $450. The bank noted that Broadcom has become a major supplier of custom artificial intelligence chips (ASICs) for hyperscale data center operators such as Google, Meta, and Amazon .

The report states, "The company controls approximately 70% of the ASIC market and offers exceptional cost-effectiveness for inference workloads." Goldman Sachs Analyst James Schneider had previously highlighted Broadcom's expanding partnerships with AI companies such as Anthropic and OpenAI.

"In fiscal year 2025, Broadcom achieved a record sales of $63.9 billion, with nearly $20 billion coming from AI-related sales. The acquisition of VMware has provided stable cash flow and expanded the company's revenue streams beyond semiconductors," the bank added.

Finally, AMD's position on the aforementioned list reflects its status as a key "second supplier" of AI chips. With Nvidia transitioning from the Blackwell architecture to the upcoming Rubin architecture, AMD has successfully captured a significant share of the hyperscale data center market with its Instinct MI350 series.

"The MI400, expected to launch in 2026, will make AMD a price-competitive alternative for cloud service providers seeking to diversify their offerings. For investors looking to invest in AI chip stocks other than Nvidia in 2026, AMD offers attractive upside potential and a relatively low valuation multiple," the analysts wrote.

(Article source: CLS)