In the week leading up to Christmas, short sellers on Wall Street surged in an unusual manner, particularly regarding the hot topic of artificial intelligence. (AI) stocks have continued to plummet.

Despite a rebound in US stocks on Thursday (18th), anxiety remains pervasive in the market. On Wednesday, the Nasdaq... The index's 1.9% drop was the largest single-day decline in 18 trading days. Oracle, the "AI Leverage King,"... ORCL shares fell 5.4% to a six-month low, down 45% from their September high; Previously, Broadcom, the highly sought-after new "AI shovel seller," also saw its shares decline. The stock price plummeted due to a poor earnings report, falling nearly 9.4% by Wednesday, a drop of about 20% from its previous high. According to CBN, short selling has surged recently, primarily driven by hedge funds, marking the largest increase in five years.

Rob Li, Managing Director of Amont Partners, a US asset management firm, told CBN that in addition to high leverage, Oracle 's volatility was mainly affected by OpenAI's fundraising capabilities. The massive amount of unfulfilled revenue obligations (RPOs, unconfirmed contracted revenue) that triggered Oracle 's surge in September accounted for $300 billion of the $523.3 billion in RPOs. Broadcom 's plunge stemmed from the lack of upside potential after its fiscal year 2026 guidance was revised upwards, coupled with concerns that Google's future development of its own customized solutions would eat into Broadcom's business. While the actual situation is not a cause for excessive concern, the high leverage of hedge funds and the already expensive valuations of AI-related stocks make them susceptible to valuation corrections.

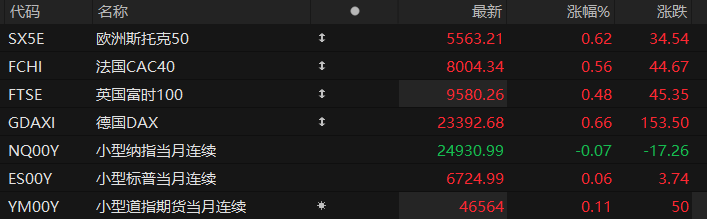

Wall Street short selling surge

Goldman Sachs According to the trader positioning report, from November 25 to December 22, traders' net long positions decreased by $4 billion; new short positions ($-$5.9 billion) outnumbered long positions ($1.1 billion). By category, short positions saw their largest increase in five years ($-$7.6 billion).

Selling pressure peaked on Wednesday. The Nasdaq 100 led the decline among U.S. stock indexes, with continued concerns about AI funding weighing on the technology sector. "The index is now forming its second bearish weekly candlestick, and if the rebound fails, the Nasdaq could fall to 26,300, slightly above the 2024 high of 23,364," Matt Simpson, a senior analyst at Gain Capital, told First Financial Daily.

Following the AI sell-off in November, this latest decline in popular AI stocks has been driven by another drop. Simpson noted that Oracle's stock price fell 5.4% on Wednesday, hitting a six-month low, after reports surfaced that its largest data... Hub partner Blue Owl will not back a $10 billion new facility deal; Nvidia It fell 2.3%, and currently shows a strong positive correlation with the Nasdaq 100 index over 20 days, with a coefficient of 0.94; Broadcom fell 4.4% on the day, with a weekly decline of 9.4%, and a coefficient of 0.97.

Fortunately, Thursday's positive news temporarily mitigated the risk of a market breakdown. US inflation fell significantly in November, with core CPI dropping to 2.6%, below the expected 3%. This also spurred a slight increase in expectations for a Federal Reserve rate cut in the first quarter of next year. Chicago Fed President Goore stated that if inflation continues to cool, interest rates will be much lower than they are now by this time next year.

Besides the data, the choice of the Federal Reserve Chair will also influence the interest rate outlook. Citigroup expects the Fed to cut interest rates by a total of 75 basis points (BP) next year. The Nasdaq rose 1.3%, the last time it rose more than 1% in a single day was on November 24, with major tech stocks all in positive territory.

OpenAI's ability to secure funding will determine Oracle's fate.

Despite a brief rebound, investors' concerns about "AI trading" are unlikely to be fully digested in the short term. Oracle can be considered one of the companies that "climbed the highest and fell the hardest" in this year's AI boom.

Oracle's success and failure both stem from OpenAI. "Everyone knows that Oracle faces significant capital expenditure pressure, but Oracle's performance is mainly affected by OpenAI. People are worried that OpenAI will not be able to continue raising funds. If the money doesn't come in, Oracle's profit margins will not be realized because customers won't come in," Li Zhaoyu told CBN.

Oracle's stock price stabilized temporarily on Thursday, driven by news from OpenAI. Reports, citing sources familiar with the matter, indicated that OpenAI aims to raise up to $100 billion to fund its ambitious growth plans. However, this funding round is still in its early stages, and if it raises all of its target funds, the company's valuation could reach $830 billion. The terms of the deal are still subject to change, and it remains unclear whether there will be sufficient investor demand to reach the target.

Oracle's reliance on OpenAI is likely to continue impacting the company's stock price. Financial data released in September showed that Oracle's Reserve Item (RPO) exceeded approximately $523.3 billion, reflecting a massive scale of contracts signed but not yet recognized over the next few years. It is understood that of this $523.3 billion RPO, contracts from OpenAI account for approximately $300 billion. This means that Oracle's RPO is largely driven by OpenAI-related orders, most of which are expected to generate revenue over the next few years. In contrast, Oracle's annual revenue was only approximately $57.399 billion, implying that Oracle faces significant debt financing pressure to fund its data center business . Construction paves the way. However, if the reliability of revenue conversion from contracts remains questionable, it will undoubtedly further undermine market confidence.

Morgan Stanley Oracle's open order backlog (RPO) increased by $67.7 billion in the second quarter, reaching a total of $523 billion at the end of the quarter, corresponding to approximately $83.8 billion in orders, demonstrating the continued strong demand for AI-related products. "However, the stock price reacted significantly negatively in after-hours trading, which we believe indicates that investors are increasingly losing confidence in Oracle's ability to convert this large (and still expanding) order backlog into sustainable, profitable revenue streams."

What has caused investors to have concerns about order conversion and free cash flow (FCF)? One reason is the increased short-term cash flow pressure due to anticipated higher capital expenditures. Third-quarter capital expenditures reached $12 billion (over 200% year-over-year), exceeding the market consensus of $8.4 billion, while free cash flow was -$10 billion. More importantly, the fiscal year 2026 capital expenditure outlook has been revised upwards to $50 billion (an increase of $1.5 billion from the previous forecast), representing approximately 75% of fiscal year 2026 revenue, to address the growth in the order backlog.

Popular stock Broadcom faces valuation pressure.

While Oracle's stock price decline was not surprising, the sudden and sharp drop in Broadcom's stock price, a "top student," has astonished the market.

Despite a sharp drop, Broadcom's stock price has still gained 40% this year. Broadcom manufactures TPUs for Google, Google's self-developed AI acceleration chips used for large-scale model training and inference. TPUs are core computing resources in Google's AI ecosystem, and their status is expected to rival Nvidia 's GPUs (the dominant chips in AI training). This means Broadcom is likely to secure stable and high-profit orders in the long term. However, the Q3 earnings call raised concerns among investors.

Broadcom's third-quarter results exceeded expectations, and the CEO provided a 100% guidance for AI revenue growth in the first quarter of next year. However, when Goldman Sachs analysts asked whether the first-quarter growth rate could serve as a good starting point for the expected full-year growth rate, Broadcom's CEO's response was perceived by investors as "arrogant" and "vague." "It's difficult for me to pinpoint exactly what 2026 will look like. So I prefer not to give you any guidance, which is why we don't provide full-year guidance, but we do provide guidance for the first quarter," he stated.

In addition, Li Zhaoyu told CBN that the market is also worried that Broadcom's overall gross margin may decline to 45%-47% after increasing the delivery of system-level products. However, in his view, this change is mainly a business structure adjustment. Although the gross margin ratio is declining, it will help expand the absolute scale of operating profit, rather than a weakness in the fundamentals.

"Meanwhile, investors' concerns about Google potentially pushing for Customer-Owned Solutions (COT) that could weaken Broadcom's business were amplified in advance. However, given the current tight supply of AI computing power and the priority given to delivery certainty, the impact is more medium- to long-term, and there is no substantial impact on Broadcom's orders in the short term." In his view, the real factor driving the stock price decline is that Broadcom's valuation is high and it has long been a core AI stock heavily crowded by hedge funds. During the overall correction in the AI theme, concentrated selling by funds amplified the volatility. Although the company has fully communicated with investment banks and clients after the earnings release, the emotional impact has already taken hold, and recovery will still take some time.

(Article source: CBN)