① The upward trend in gold prices is expected to continue into 2026; ② IG Group analysts pointed out that in 2026, the rise in gold prices will not require a crisis to drive it, as long as the world maintains its current operating trend; ③ He pointed out that compared with the previous peak, investors' current positions in gold are still relatively balanced, indicating that the market is not overcrowded.

International gold prices have repeatedly hit new highs this year, with spot gold surpassing $4,500 per ounce for the first time in Asian trading on Wednesday. Gold prices have risen more than 70% so far, poised for their best annual performance since 1979. This upward trend is expected to continue into 2026.

Analysts predict that gold prices will continue to rise next year because the current price increase is driven by structural factors rather than simple reactive fluctuations (caused by sudden events) .

"In 2026, gold prices will not need a crisis to drive them up; all that's needed is for the world to maintain its current trajectory: high debt levels, policy uncertainty, fragile alliances, and the gradual decline of the dollar's dominance," wrote Farah Mourad, a market analyst at IG Group, a long-established British online brokerage.

“In this environment, gold doesn’t need to chase fear, but rather digest it,” Mourad added.

IG did not provide a specific gold price forecast, but noted that major investment banks expect gold prices to trade in the $4,500-$4,700 range per ounce next year, and if the current macroeconomic environment continues, gold prices could potentially reach $5,000.

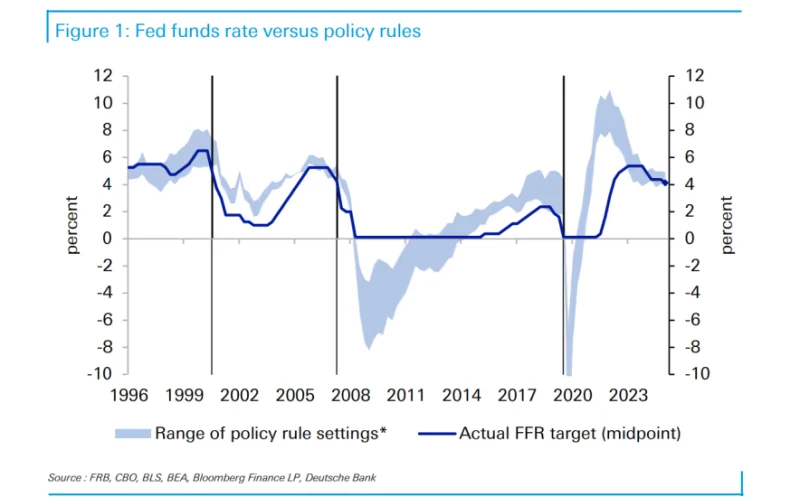

Monetary policy may provide additional support for gold prices. With inflation sticking less and the job market cooling, the market expects the Federal Reserve to cut interest rates further next year. This is crucial for gold prices because when real yields fall, the opportunity cost of holding non-yielding assets like gold decreases, and gold prices tend to perform better.

Of course, risks remain. If the dollar rebounds more strongly than expected, or if market risk appetite continues to rise, it could slow the pace of gold price increases.

However, Mourad points out that current investor positions in gold remain relatively balanced compared to previous peaks, indicating that trading has not yet become overcrowded .

Wall Street is generally bullish on gold prices next year.

Currently, major investment banks on Wall Street are generally optimistic about gold's performance next year.

ING Ewa Manthey, a commodities strategist at ING Group, predicted earlier this month that gold prices will reach a new all-time high in 2026. She pointed out that factors driving the continued bull market in gold include the possibility that the next Federal Reserve chair nominated by US President Trump will favor interest rate cuts.

Manthey added that gold prices may find support on any pullback. "We expect limited downside for gold, as any weakness could rekindle interest from both retail and institutional buyers," she said.

Goldman Sachs It is predicted that gold prices will climb to $4,900 per ounce by December 2026; JPMorgan Chase Gold prices are projected to average $5,055 in the fourth quarter of 2026; meanwhile, Yardeni Research, an independent investment research firm founded by Wall Street veteran strategist Yardeni, recently raised its target price for gold next year to $6,000.

(Article source: CLS)