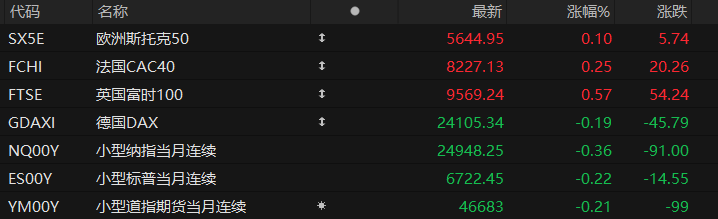

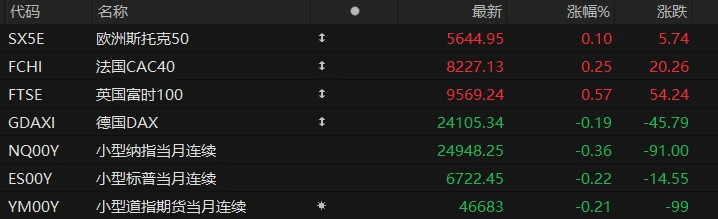

U.S. stock futures fell across the board in pre-market trading on Thursday, while most major European indices rose. As of press time, the Nasdaq... S&P 500 futures fell 0.36%, S&P 500 futures fell 0.22%, and Dow Jones futures fell 0.21%.

In terms of individual stocks, Tesla Tesla shares continued their pre-market decline, currently down over 3%, despite a significant rebound in Q3 revenue, but a sharp 31% drop in earnings that exceeded expectations. Meanwhile, Musk downgraded his robot... And Robotaxi targets. Nokia U.S. stocks rose 9.7% in pre-market trading. Quantum computing concept stocks generally rose, with Quantum Computing up 13%. IBM fell more than 6%, as Red Hat's cloud services business growth slowed.

Popular Chinese concept stocks showed mixed performance in pre-market trading, with NetEase... Alibaba Baidu Pony.ai Hesai JD.com TSMC rose more than 1%. NIO , shell Up about 0.5%; BaWangChaJi XPeng Motors Bilibili It fell by about 0.5%.

Market sentiment remains influenced by factors such as corporate earnings and trade tensions. Gold, silver, and oil prices rebounded collectively. As of press time, WTI crude oil rose 5.18% to $61.53 per barrel, while Brent crude oil rose 4.71% to $65.54 per barrel. US Treasury yields rose, the US dollar index stabilized around 99, cryptocurrencies rose, and Bitcoin rose more than 1%.

Investors are closely watching corporate earnings reports from Europe and the US, as financial data can play a crucial role in market trends. Pepperstone Group Ltd strategist Wu Dilin stated, "The momentum trading that previously led multiple asset classes is now pulling back. The greater risk comes from earnings. Strong earnings may stabilize market sentiment, but any disappointing earnings—especially from growth stocks or technology stocks—could exacerbate the current pullback."

Hot News

Wall Street bulls: Despite subdued investor sentiment, the S&P 500 is still expected to reach 7,000 points by the end of the year.

Tom Lee, chief investment officer at Fundstrat Capital, called the 2025 market “the most dreadful V-shaped rebound ever.” He noted that investor pessimism had reached levels typically seen only during severe bear markets. Despite this, he expressed optimism about the S&P 500 . The expectation remains that the 500 will reach 7000 points by the end of the year.

In his latest report released on October 21, Lee pointed out that the persistent and negative investor sentiment is a significant anomaly. He specifically highlighted recent survey data from the American Investors Association (AAII), which showed that there were more bears than bulls, a trend that persisted throughout the year.

Lee stated, "The last time we experienced this kind of 'trough' of negative sentiment was in 1990, 2008, and 2022. These were all bear market years."

He compared this deep-seated fear with the actual market performance and pointed out, "Investors are behaving as if we are in a bear market, yet the market has risen 13% so far this year. So, I call this the most disgusting V-shaped rebound ever."

International crude oil prices surged 5% in a single day as new US and European sanctions against Russia shook the market.

The United States announced sanctions against two major Russian oil companies, triggering market concerns about supply constraints and a restructuring of the global trade landscape, causing international oil prices to rise sharply during the day.

According to specific market data, as of press time, the main contract price of WTI crude oil futures on the New York Mercantile Exchange rose by about 5.5%, having risen by more than 5.6% intraday to $61.88 per barrel, the highest level since October 10; the main contract price of Brent crude oil futures rose by 5.2% to $65.82.

According to Xinhua News Agency, U.S. Treasury Secretary Bessenter announced overnight that the United States would impose sanctions on Russia’s two largest oil companies, Rosneft PJSC and Lukoil PJSC, and urged Russia and Ukraine to immediately cease fire.

According to relevant U.S. regulations, the assets of sanctioned entities within the United States will be frozen, and U.S. citizens are prohibited from engaging in transactions with them. In his statement, Bessenter accused Russia of refusing a ceasefire and alleged that sanctioned Russian oil companies funded Russia's special military operations in Ukraine.

On the same day, EU member states reached an agreement on the 19th round of sanctions against Russia. According to a previous statement, the EU will lower the price ceiling for Russian crude oil to $47.6 per barrel, and the two Russian oil companies mentioned above will face a complete trading ban.

The United States has established a critical minerals fund with a target size of $5 billion!

According to media reports on Thursday, the U.S. government, together with private equity firm Orion Resource Partners and Abu Dhabi's sovereign wealth fund ADQ, has established a critical minerals investment fund. The three parties have committed to an initial capital of $1.8 billion and set a final target size of $5 billion.

This investment from the U.S. International Development Finance Corporation (DFC) is a key step in the Trump administration's efforts to secure mineral deals globally.

The fund will focus on strategic minerals such as copper, cobalt, and rare earth elements, resources crucial to the defense industry and energy transition. The United States and its allies are generally anxious about the future supply of such materials.

The new fund will prioritize investments in existing or soon-to-be-produced assets, rather than early-stage exploration projects. This marks a strategic shift by the US government in the mining sector since Trump's return to the White House, moving from policy-driven initiatives to direct capital intervention.

US Stocks Focus

Intel's stock price soared and funds poured in. Facing the test of high performance threshold

Previously, the White House and Nvidia A wave of investments from NVDA.US and Softbank Group Corp. has sent Intel's (INTC.US) stock price soaring 86% in less than three months. The chipmaker is set to release its third-quarter earnings report after the market closes on Thursday, and investors will be focusing on the deeper information revealed in the results, in addition to the net profit figures.

The stock price surged so rapidly that several analysts downgraded its rating in recent weeks. (Bank of America) Last week, in a report to clients, Intel's rating was downgraded from "neutral" to "underperform," with concerns expressed that the stock had "risen too fast and too high." The surge in market enthusiasm has also driven up Intel's stock valuation—its forward 12-month price-to-earnings ratio is now 63, far higher than the approximately 20 in January, placing it among the 15 most valued companies in the S&P 500.

This increase is particularly noteworthy because just about a year ago, Intel was removed from the Dow Jones Industrial Average—an index it had been a member of since 1999—and replaced by its competitor, artificial intelligence. Nvidia, a leading company in the field.

On Wednesday, the Trump administration indicated it was considering export restrictions on the technology sector to China. This news put pressure on Intel's stock price, which closed down 3.2% at $36.92, though this price remained well above the market consensus 12-month target price of $28.80. (Philadelphia Securities) Exchange Semiconductor The index fell 2.4% that day, with all but one constituent stock closing lower.

Joe Tigay, portfolio manager at Gabelli Funds, said Wall Street generally expects Intel's latest earnings report, due after the market closes on Thursday, to be disappointing. Tigay's Catalyst Nasdaq 100 Hedge Fund holds Intel shares, while the Rational Stock Defense Fund has liquidated its Intel holdings.

Nokia CEO: We are still in the early stages of the AI supercycle, just like the internet in the 1990s.

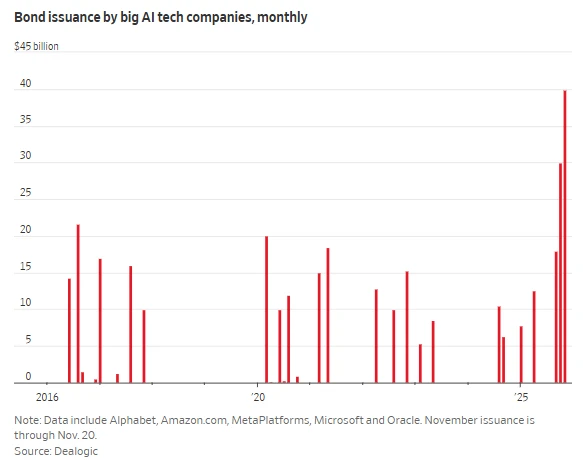

Nokia CEO Justin Hotard said on Thursday that artificial intelligence (AI) is driving a long-term growth cycle similar to the internet boom of the 1990s, downplaying concerns about a growing “AI bubble” in the market.

In an interview that day, Hotard pointed out that the debate surrounding the sustainability of AI investment is becoming increasingly intense.

“I firmly believe that we are in the early stages of an AI supercycle, just like the internet in the 1990s. Even if there are bubbles or downturns in between, we will still focus on long-term trends, which are currently very positive.”

Hotard's remarks come at a time when the global frenzy for AI is facing sharp scrutiny regarding whether a bubble exists. A Bank of America survey this month showed that more than half of fund managers believe AI stocks are in a bubble.

Core growth engine stalls! Red Hat's slower-than-expected growth drags down IBM's performance.

IBM reported disappointing revenue in two key software categories, one of which includes the closely watched Red Hat division.

IBM reported third-quarter revenue of $16.33 billion, a 9.1% year-over-year increase, exceeding expectations; excluding certain items, profit was $2.65 per share, also exceeding market expectations. The hybrid cloud segment, including Red Hat, saw sales grow by 14% in the third quarter, a slowdown from the previous quarter and below the average analyst estimate of 16%.

For the fiscal year ending in December, IBM said its free cash flow would reach approximately $14 billion, higher than analysts' estimates of $13.5 billion. As of press time, IBM shares were down more than 6% in pre-market trading on Thursday.

Strong consumer demand in the North American market led to Unilever's core sales exceeding expectations in Q3.

Unilever's third-quarter sales exceeded expectations, driven by strong demand in developed markets, particularly North America, and cost control measures. The company stated that sales of its core products grew 3.9% year-over-year, slightly above analysts' forecasts of 3.7%.

Operating revenue declined by 3.5% to €14.7 billion, due to adverse effects from currency factors (6.1%) and asset disposals (1%). However, volume increased by 1.5%, and prices rose by 2.4% (higher than analysts' expectations of 2.2%). Excluding the ice cream business, core sales increased by 4%.

Unilever reiterated its full-year earnings guidance, expecting core sales to grow by 3% to 5%. As of press time, Unilever shares were up more than 2% in pre-market trading on Thursday.

(Article source: Hafu Securities )