According to an investment executive at one of Australia's largest pension funds, China is seeing more artificial intelligence... The rollout of this tool could cause a sudden plunge in the stocks of U.S. tech giants that have bet on generative artificial intelligence .

On Wednesday (October 29), at an investment management forum, John Pearce, chief investment officer of Australian superannuation fund UniSuper, said, "DeepSeek's research results show that Chinese companies are capable of developing large models at lower costs and providing similar products. In contrast, American companies have high costs in this regard, but their output is only comparable to the former."

UniSuper manages A$158 billion (US$104 billion) in assets, making it one of Australia's largest superannuation funds.

Pearce pointed out that his concern stems from the fact that "if Chinese companies are developing their own language models at a much lower cost than American companies, while still offering the same products, then this raises serious questions about the business models of American tech giants."

Pearce also mentioned that the increasing risks posed by China's "DeepSeek moment" pose an immediate threat to the valuation of US tech stocks, but this is rarely mentioned.

Is it a bubble or not?

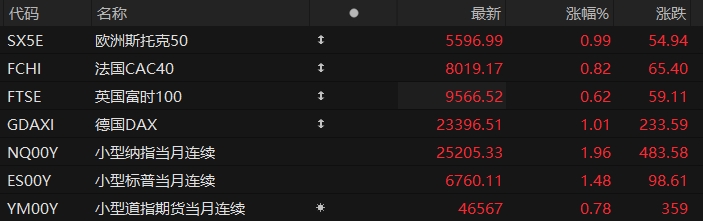

This week, US tech stocks hit new record highs, with Microsoft... Nvidia And Apple Their current market capitalization has exceeded $4 trillion.

Critics argue that AI- related stocks are overvalued, many companies are still in the early stages of validating concepts, and investor enthusiasm mirrors that of past tech bubbles.

However, Pearce maintains a more optimistic outlook, partly because developed countries have entered an era of "continuous stimulus."

Pearce said, "This creates some pretty good investment opportunities in areas like private lending. I'm quite bullish on private lending because I'm not too worried about the economic cycle."

(Article source: CLS)