The following are the latest ratings and target prices for US stocks from various brokerage firms:

China Merchants Securities (Hong Kong) Maintains Futu Holdings (FUTU.O) Buy rating, target price $226:

The company's fundamentals are solid, benefiting from strong trading volume in Hong Kong and US stocks and improved net interest income. Although short-term impacted by regulatory sentiment, the company's diversified portfolio, with over 50% of its accounts held overseas, mitigates risk. Favorable trading volume and interest rate environment in Q3 2025 suggest EPS may exceed expectations. Current valuation is below peers, offering an attractive risk-reward ratio.

CITIC Securities Give oracle bone script (ORCL.N) Sell rating, target price $243:

The company's IaaS business relies on a single customer, OpenAI, raising questions about its growth certainty. It also faces a significant capital expenditure shortfall and high debt levels, with an unclear profit path. Its gross margin is lower than its peers, and earnings are expected to materialize only after FY2027, putting it under short-term pressure. Therefore, the rating is downgraded to "Sell".

SPDB International maintains its Buy rating on Sea Ltd ADR (SE.N) with a target price of $190.

3Q25 revenue is projected to increase by 28% year-over-year to $5.56 billion, with adjusted EBITDA increasing by 58% year-over-year. Shopee's GMV saw strong growth, and Garena Games... With accelerated cash flow, Monee's loan portfolio is expanding. Although short-term profit margins are under pressure, the increased investment is expected to solidify its leading position and enhance its long-term growth potential.

China International Capital Corporation We maintain our Outperform rating on Sea Ltd ADR (SE.N) with a target price of $193.

We project 3Q25 revenue of $5.6 billion (YoY +30%) and adjusted EBITDA of $880 million (YoY +85%), benefiting from Shopee GMV growth and the advancement of our partnership with Garena. High growth in digital finance revenue and expansion of lending outside the ecosystem are driving economies of scale. We have raised our 2026 revenue forecast and increased our target price to $193 based on SOTP valuation, representing a 24.8% upside.

Haitong International maintains its "Buy" rating on Hermès International (HESAF.F):

3Q25 revenue increased by 10% year-on-year (at constant exchange rates), driven by improvements in Asia, a 15% increase in Japan, and a 13% increase in leather goods. Apparel and accessories remained stable, with the new creative director injecting long-term brand vitality. Production capacity increased by 6-7% year-on-year, and store optimization improved sales per square meter; the full-year operating profit margin is expected to be around 40%. High customer loyalty and scarcity support counter-cyclical capabilities; growth guidance is maintained.

Industrial Securities Maintain Philip Morris International (PM.N) Buy rating:

The company achieved record revenue in Q3 2025, with smokeless product revenue increasing by 17.7% year-on-year, accounting for 41% of total revenue and driving overall performance growth. Gross margin improved by 1.8 percentage points to 67.8%, and adjusted EPS guidance was raised to US$7.46-7.56, a year-on-year increase of 13.5-15.1%. High growth in shipments of new tobacco products such as HNB and oral tobacco products, coupled with a steady increase in dividends, demonstrates strong profitability and a willingness to return returns to shareholders.

CICC maintains its "Outperform" rating on Futu Holdings (FUTU.O) with a target price of $250.

Benefiting from the active Hong Kong and US stock markets, Q3 2025 profit is expected to increase by 112% year-on-year, with double-digit growth in client assets and trading volume, and simultaneous increases in interest income and commissions. Non-GAAP net profit margin has improved to 51%. Overseas expansion and virtual asset business will contribute to long-term growth. The current valuation is low, and upward revision of earnings will drive valuation revaluation.

Haitong International maintains its Buy rating on Kering SA ADR (PPRUY.F):

Kaiyunji The group's revenue decline narrowed in Q3 2025, with core brands showing sequential improvement. Gucci, Saint Laurent, and Bottega Veneta all showed signs of recovery. The new CEO's appointment has driven structural transformation, optimizing store and channel structure and improving operational efficiency. The sale of the beauty business generated net proceeds, and a partnership with L'Oréal strengthens the long-term growth potential in the high-end wellness sector. A return to growth is expected in 2026.

First Shanghai maintains Netflix (NFLX.O) Buy rating, target price $1,319:

Increased streaming penetration supports user growth, advertising revenue is expected to double, and optimized content spending drives free cash flow upward to $9 billion. Although Brazilian taxes impact short-term profits, core profitability remains solid. DCF valuation indicates a 20.5% upside, with a gradually declining PE ratio from 2025 to 2027, demonstrating clear growth potential.

CICC maintains its position on Autohome (ATHM.N) Neutral rating, target price $29:

Revenue for Q3 2025 is projected to decline by 1.8% year-on-year to RMB 1.74 billion, with a non-GAAP net profit margin of 22.5%. Traditional advertising and lead generation businesses are under pressure, but new retail... Innovative businesses grew by 17.5% year-on-year. The launch of the "Car Mall" marks a breakthrough in the O2O strategy, and the offline delivery system is gradually being improved. Short-term profits are affected by investment in new businesses, leading to a downward revision of profit forecasts. However, we are optimistic about long-term growth potential, and the current price has an upside potential of 11.6%.

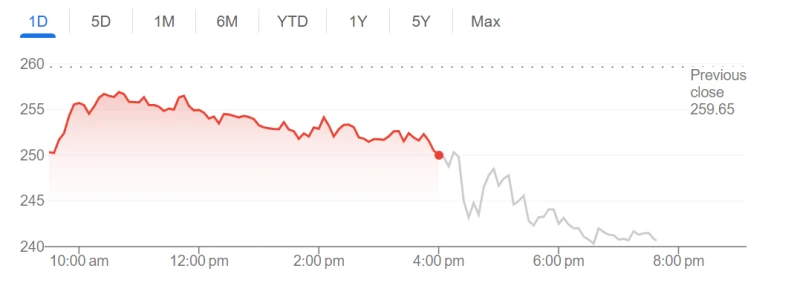

CICC maintains Microsoft's (MSFT.O) Outperform rating, target price $560:

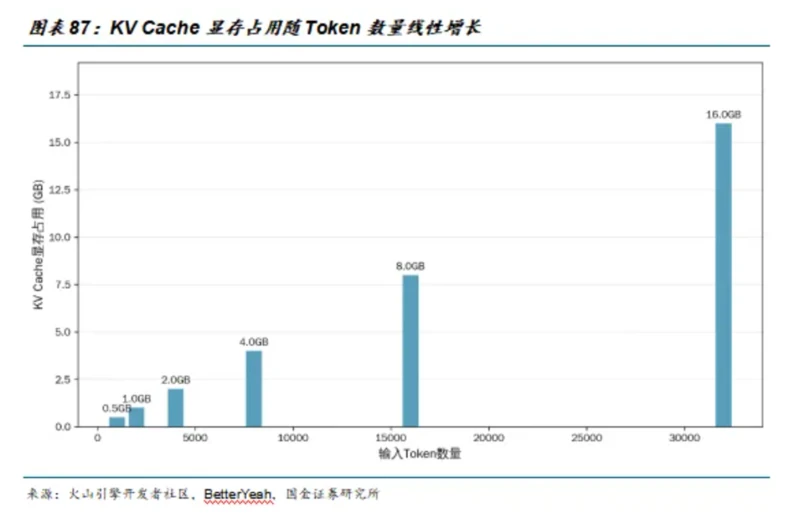

We project Q1 FY26 revenue growth of 15.4% year-over-year, with Azure cloud growth at 37%, driven by continued demand for computing power from enterprise customers fueled by AI. The company has completed its AI ecosystem integration, boosting token consumption and cloud market share. While short-term constraints exist due to computing power supply limitations, these are expected to ease in the second half of the year. Our target price is based on a 35x/30x P/E ratio for FY2026/27, reflecting the long-term growth potential driven by AI synergies.

(Article source: CLS)