For the past year, the US labor market has been characterized by a pattern of "no hiring, no layoffs." However, the trend of "no hiring, more layoffs" is becoming increasingly apparent, which may provide more justification for the Federal Reserve to cut interest rates.

retail giant Amazon On Tuesday, one company announced plans to lay off 14,000 employees, with further layoffs scheduled for next year; meanwhile, UPS, a logistics and delivery service provider, disclosed that it had already cut 48,000 jobs in the past year. The reasons given by these companies for the layoffs include protecting profit margins, increasing AI applications, and reversing over-hiring during the pandemic.

In fact, the recent layoff announcements that shocked many Americans are not limited to this: Intel Microsoft will lay off approximately 25,000 employees. Accenture lays off 15,000 employees . The Trump administration also laid off 11,000 government employees during the government shutdown.

According to statistics from global recruitment agency Challenger, Gray & Christmas, U.S. employers announced nearly 950,000 layoffs from January to September this year, with the hardest-hit sectors including government, technology and retail.

Although some of these layoffs occurred at the beginning of the year, a series of recent trends indicate that cracks are truly beginning to appear in the U.S. labor market, which confirms the views of many Federal Reserve officials, including Chairman Powell, that the downside risks to employment currently outweigh the upside risks to inflation.

Analysts say the U.S. labor market is gradually forming a more streamlined new normal —large corporations are laying off workers and drastically reducing white-collar positions, which reduces job opportunities for experienced employees and recent graduates who relied on high-paying white-collar jobs to support their families and save for retirement. According to recent federal government data, nearly 2 million Americans have been unemployed for 27 weeks or more.

Behind the wave of white-collar layoffs, part of the reason is companies' concerns about artificial intelligence. Executives are enthusiastic, hoping that artificial intelligence can take over more of the work previously done by highly paid white-collar workers. Investors are urging executives to improve productivity with fewer employees. Factors contributing to the hiring slowdown also include political uncertainty and rising costs.

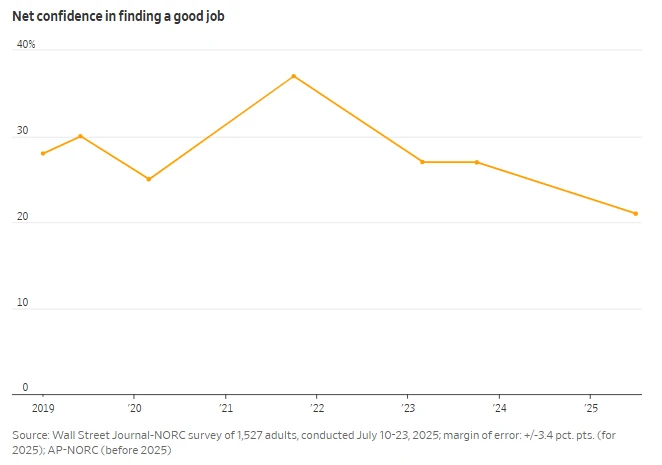

A series of corporate restructurings has left managers and employees feeling uncertain about their future, and job seekers with even more limited options. A survey this year by the NORC Center for Public Affairs Research showed that only about 20% of Americans said they were very or extremely confident in finding a good job, a lower percentage than in previous years.

Unsettling signals of a data gap

After a nine-month pause in interest rate cuts, the Federal Reserve restarted its easing cycle in September, announcing its second consecutive rate cut this Wednesday. Meanwhile, many investors, concerned about a weak labor market, expect the Fed to continue its accommodative policy into next year. Labor market data shows that while the US unemployment rate has not risen significantly, this is mainly attributed to a contraction in labor supply offsetting a cooling labor demand – the Trump administration tightened immigration policies and intensified deportations.

In normal times, layoffs at individual companies might not attract policymakers' attention. But these are not ordinary times—we are experiencing the second-longest government shutdown in U.S. history , resulting in the near-four-week absence of almost all labor market data—including monthly employment figures, the unemployment rate, Job Openings and Labor Mobility (JOLTS), and weekly unemployment claims. Federal Reserve officials are essentially flying blind.

Therefore, in the absence of official data guidance, the aforementioned specific corporate announcements may be particularly important.

SMBC Nikko Securities Troy Ludtka, senior U.S. economist at Americas, noted that while the announcements from Amazon and UPS will not change policy direction in the short term, they should confirm the Federal Reserve officials' "concerns" about the labor market. "The key question now is: how much will other companies lay off workers?"

In fact, while the Federal Reserve awaits its answer, the limited number of existing official economic indicators have already sounded alarm bells.

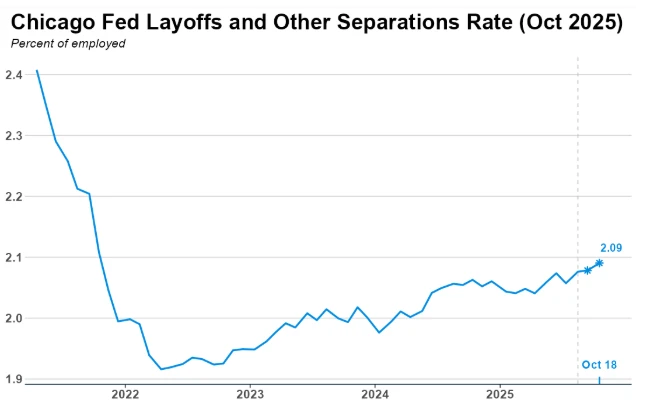

The Chicago Fed's economic model (which uses private sector data when official government data is unavailable) shows that the proportion of "layoffs and other departures" among employed workers is continuing to rise, while the proportion of "employed unemployed" among the total unemployed population is declining. Both indicators have reached levels not seen in four years.

Meanwhile, the United States Automatic Data Processing Preliminary weekly data released Tuesday by ADP showed that the U.S. private sector added an average of only 14,250 jobs per week in the four weeks ending October 11. ADP, which usually releases monthly reports, said it will now release preliminary weekly estimates every Tuesday, based on high-frequency data.

Such a slight increase essentially means zero job growth—although this is better than the 32,000 job losses reported in ADP's September monthly report last month.

Overall, the state of the U.S. labor market appears to provide justification for the Federal Reserve to cut interest rates. However, such accommodative policies are not without risks—Wall Street, led by tech and AI stocks, is booming, and financial conditions are at their most relaxed in years. Meanwhile, the U.S. inflation rate is still a full percentage point above the Fed's target.

While the initial intention behind interest rate cuts may be good—aiming to protect millions of workers at risk of unemployment—the loose monetary policy will fuel a continued "meltdown" rally. Therefore, although the actual support the rate cuts will provide to the labor market remains unclear, it will almost certainly increase the portfolio value of wealthy asset holders. At the same time, it is equally certain that the more companies announce large-scale layoffs, the greater the likelihood that the Federal Reserve will continue its accommodative actions.

(Article source: CLS)