Advanced Micro Devices (AMD) will release its third-quarter earnings report after the US stock market closes on November 4, 2025 (this Tuesday). The market consensus expects revenue to reach $8.75 billion, a year-on-year increase of 28.3%, and earnings per share to be $1.17, a year-on-year increase of 27.2%.

I. Brief Review of Q2 Financial Report

Advanced Micro Devices AMD reported revenue of $7.685 billion in the second quarter of 2025, a 32% year-over-year increase, demonstrating solid performance. Non-GAAP net income was $781 million, a 31% year-over-year decrease, and gross margin declined year-over-year, impacted by inventory impairment of the MI308 chip and increased R&D investment. The second-quarter results were affected by US government export controls, which limited sales of the MI308 chip, directly impacting AMD's data center business. These restrictions resulted in approximately $800 million in inventory and related expenses. Excluding these expenses, the non-GAAP gross margin was approximately 54%.

II. Q3 Earnings Preview

Focus and Expectations under Major Cooperation

AMD's stock price has recently surged due to a series of deep collaborations. Among these, the strategic partnership with OpenAI has garnered the most market attention: AMD will provide OpenAI with a total of 6 gigawatts of dedicated computing power, with the first 1 gigawatt Instinct MI450 GPU accelerator cluster planned for deployment in the second half of 2026. The collaboration also involves an equity arrangement, with OpenAI authorized to purchase 160 million shares of AMD common stock and to gradually increase its holdings over the next five years. Industry estimates suggest this partnership could generate over $100 billion in revenue for AMD over the next five years.

Meanwhile, AMD reached a $1 billion supercomputer construction agreement with the US government, aimed at driving scientific breakthroughs in areas such as nuclear energy, cancer treatment, and national security. In addition, the company has a partnership with Oracle . IBM and Supermicro computers Cooperation with these companies is also continuing to deepen.

Although the initial deployment of computing power will not be completed until 2026, and current results do not yet reflect the benefits of the collaboration, market expectations for AMD's long-term growth in the AI computing power field have significantly strengthened. Investors are watching to see if this earnings report will provide clearer guidance on the progress of the collaboration.

Whether data center revenue can exceed expectations is the biggest point of interest.

In the upcoming Q3 2025 earnings report, AMD 's data center business revenue performance will be a key focus of market attention. In the previous quarter, AMD's data center segment achieved revenue of $3.2 billion, a year-over-year increase of 14%, primarily driven by... Increased market share in data center CPUs is driving revenue growth. Analysts expect this momentum to continue: expanding cloud deployments, growing demand for AI-powered intelligent agents, and procurement by hyperscale data center operators will all support demand for the company's products. The market is currently optimistic about AMD's data center business, with revenue expected to grow 17% year-over-year to approximately $4 billion. Specifically, the adoption rate of AMD Instinct MI350 GPUs by enterprises and the telecom industry is rising, and the MI350 series GPUs are expected to accelerate sales, driving revenue growth. The MI400 series, planned for release in 2026, features an integrated design and offers advantages in memory bandwidth, aiming to lay the foundation for growth in 2027 and beyond.

However, it is worth noting that the sales of the MI308 series chips, hampered by export controls to China, will remain the main pressure dragging down data center growth in Q3.

game The recovery trend of the client business segment continues

As of the second quarter of 2025, the Gaming & Client segment accounted for 47% of AMD's total revenue, remaining the company's largest revenue source. The segment's recovery continues to be strong, with robust demand for semi-custom game console system-on-chips (SoCs) and client GPUs, particularly the Radeon 9000 series GPUs, especially the X3D processor, which is actively ramping up production to meet market demand. Furthermore, AMD has integrated AI capabilities into its Ryzen and Radeon product lines, a move that will further support demand and drive revenue growth in the Gaming & Client segment as AI-enabled gaming PCs and handheld devices become more widespread.

Valuation premium is too high

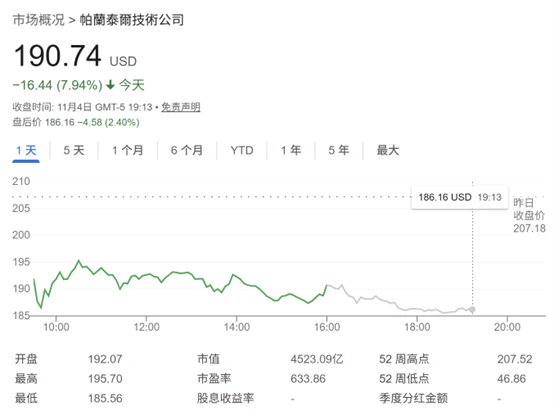

Currently, AMD's stock price has surpassed $250, representing a cumulative increase of approximately 115% since 2025. This recent surge has led to a significantly inflated valuation: AMD's current forward-looking non-GAAP price-to-earnings ratio is 64.69. This ratio is not only far higher than its five-year average forward-looking price-to-earnings ratio of 38.6, but also significantly higher than its competitor Nvidia. The forward P/E ratio is approximately 45.

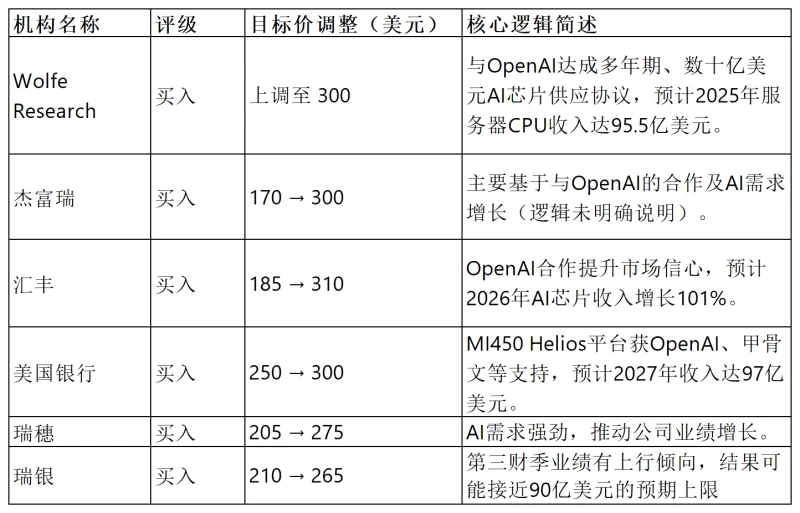

III. Institutional Views

Institutional targets have generally been raised. The core bullish logic is highly consistent, primarily revolving around deep cooperation with OpenAI and AI chips. Strong demand growth and the market potential of new products.

IV. Option Signals

There is significant divergence between bulls and bears, and the implied volatility (IV) is at a high level.

Looking at the current AMD options market, the put/call ratio is 0.61. This figure has fluctuated significantly recently, indicating that bullish and bearish forces have alternately dominated the market. Options trading volume has declined somewhat after the stock price surge. In terms of volatility, the current implied volatility (IV) of the AMD options market is 69%, reaching the 90th percentile, while its historical volatility is 96%, all at relatively high levels. This suggests that the options market has significant disagreement regarding stock price fluctuations after the earnings release.

Looking back at the stock price performance after previous financial reports, the predicted volatility of the stock price after Q3 is 8.62%, which is similar to the predicted volatility of previous quarters.

V. Summary

The market will closely watch whether its core data center business can achieve better-than-expected growth in this earnings report to justify its current high valuation. In the short term, the stock price has already significantly priced in the positive news, and the options market shows a sharp divergence between bulls and bears, meaning that the risk of volatility after the earnings report is significantly increased. Therefore, this earnings report is not only a window to examine its short-term performance, but also a "stress test" of whether its AI narrative can successfully translate into reality.

(Article source: Hafu Securities) )