Ray Dalio, the "godfather" of hedge funds and founder of Bridgewater Associates, has issued multiple warnings this year, stating that he sees the U.S. economy in a very dire state.

On Thursday, Eastern Time, he again warned that the US economy may have entered the later stages of a "major debt cycle," and that the Federal Reserve's loose monetary policy is stimulating further expansion of the bubble. However, the moment the Fed is forced to tighten monetary policy will be the moment the bubble bursts.

The Fed's rate cuts will stimulate the bubble to grow.

In recent months, Dalio has been concerned about the sharp rise in U.S. debt levels and the impact of high fiscal deficit spending; now, he has also issued a warning about the direction of monetary policy.

The Federal Reserve has cut interest rates twice this year, and the market is betting that the Fed is likely to cut rates again in December—the CME FedWatch Tool shows that the market expects a 68% probability of the Fed cutting rates by 25 basis points in December.

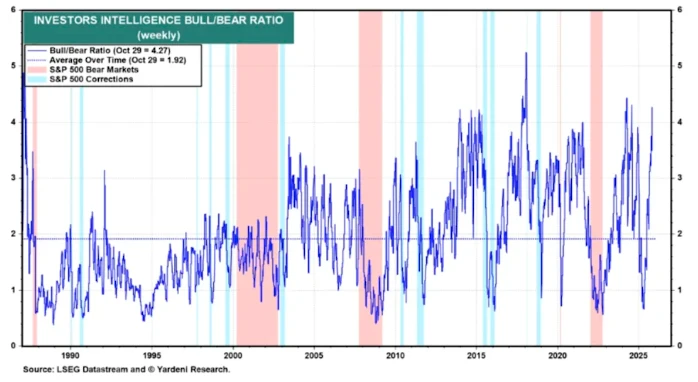

Dalio stated that he is concerned that the Federal Reserve's interest rate cuts will stimulate a larger, more dangerous bubble in the market and the economy—and he anticipates that the market may experience one last surge before the bubble bursts.

Dalio's analysis focuses on the "major debt cycle"—one of his core ideas. Dalio frequently uses this framework to explore the interrelationships between debt, money, and public policy in order to explain why the economy functions in certain ways.

Dalio believes that the Federal Reserve's decision to shift to a more dovish policy marks the final stage of the major debt cycle.

“We should not overlook the fact that when the supply of U.S. Treasury bonds exceeds the demand, the central bank ‘prints money’ to buy bonds, and the Treasury shortens the maturity of bonds sold to make up for the demand gap for long-term bonds, these are typical dynamics in the late stage of the ‘big debt cycle’.”

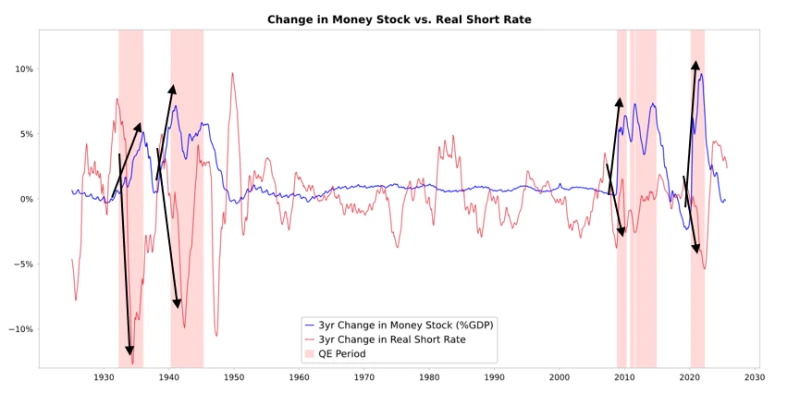

Dalio points out that bond purchases by the Federal Reserve and/or other central banks create liquidity and lower real interest rates.

He pointed out: "It is reasonable to expect that the situation will be similar to that of late 1999 or 2010-2011, with a strong surge in liquidity that will eventually become too dangerous and must be restricted. The typical time to sell is after this surge in liquidity and before the implementation of tightening measures ."

Is the market about to experience its final feast?

Dalio believes the bull market driven by US tech stocks this year will continue in the short term, primarily fueled by the ongoing AI boom. While some market professionals have expressed concerns that tech stock valuations are already too high, Dalio's argument suggests that the Federal Reserve's accommodative policy measures may sustain this momentum in the short term .

However, he also believes this momentum will be short-lived, and if history is any guide, the bubble is destined to burst. Dalio also offered some advice on stocks he believes might benefit from changes in economic conditions.

He stated, "Once inflation risks reappear, companies with tangible assets, such as mining companies, infrastructure companies, and physical asset companies , may outperform companies that are purely engaged in long-term technology businesses."

(Article source: CLS)