① OpenAI Altman: The US government does not need to fund OpenAI data centers Provide guarantees; ② TSMC The company plans to issue NT$23.5 billion in bonds with a 5-year maturity and an interest rate of 1.5%; ③ Tesla Shareholders' meeting voted in favor of investing in Musk's artificial intelligence company . Company xAI.

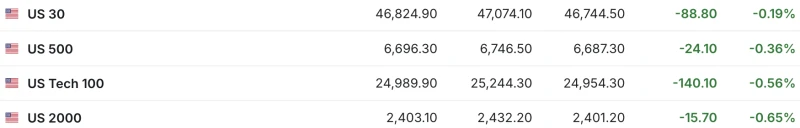

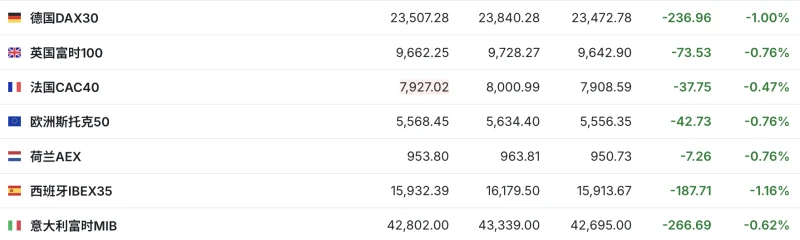

On Friday, technology stocks continued their decline, indicating that market sentiment remained weak, and futures for the three major U.S. stock indexes continued to fall. Major European indices also declined across the board.

(Source: Investing.com)

Major U.S. stock indexes closed lower across the board on Thursday, with the tech-heavy Nasdaq falling 1.9% and the Dow Jones Industrial Average dropping nearly 400 points.

The U.S. nonfarm payrolls report is usually released on the first Friday of each month, but it was delayed due to the record-breaking U.S. government shutdown. Private employment data released on Thursday showed a weak labor market, which fueled yesterday's sell-off.

Globally, concerns about the valuation of artificial intelligence (AI) related stocks have spread to companies such as SoftBank and Samsung. Japan's Nikkei 225 index fell more than 4% this week, and South Korea's KOSPI index fell 3.74%, both marking their worst weekly performances since early April.

Some market participants are still hoping for a rebound in US stocks by the end of the year. They believe that if the US government shutdown ends and the Federal Reserve cuts interest rates in December, market pressure could ease.

Investors are also watching the U.S. Supreme Court's questioning of the legality of Trump's tariffs, as well as the progress of third-quarter corporate earnings reports.

Louis Navellier, founder and chief investment officer of Navellier & Associates, stated that a rebound is still possible by the end of the year once the government shutdown ends and tariff issues are resolved. We are close to Nvidia... With earnings reports two weeks away, that could be a catalyst for reaffirming our investment logic in AI. If a December rate cut follows, we might still be able to close the year at a high level.

“A correction at such a level of increase is normal and foreseeable, and there is no need to panic,” Navellier added.

Nvidia shares fell more than 1% in pre-market trading, bringing their weekly decline to 7%. Oracle, another major player in the AI field... It also fell more than 1% in pre-market trading, and has fallen about 7% this week as well.

Palantir fell more than 1% in pre-market trading, bringing its cumulative decline this week to over 12%.

Company News

[OpenAI's Altman: No U.S. government guarantee is needed for OpenAI's data centers ]

On November 6 local time, OpenAI CEO Sam Altman posted an article stating that OpenAI does not need and does not want the US government to provide guarantees for OpenAI data centers .

The day before, OpenAI CFO Sarah Friyal said she recommended that the U.S. government "back up" the company's aggressive investments in artificial intelligence infrastructure. Friyal said, "This backing up or guarantee would allow financing to proceed, would really reduce financing costs, and would increase the loan-to-value ratio, thereby increasing the amount that can be borrowed for the equity portion."

Tesla shareholder meeting votes in favor of investing in Elon Musk's AI company xAI

On November 6th local time, Tesla's shareholder meeting voted in favor of Tesla , with some shareholders abstaining. Tesla invested in xAI, Elon Musk's artificial intelligence company. While this investment decision raised concerns about a conflict of interest, it is believed to benefit both Tesla and xAI.

Airbnb Q3 2025 revenue increased by 10% year-on-year; AI development will be accelerated in the future.

On November 7th, Airbnb released its financial results for the third quarter of 2025. Revenue increased by 10% year-over-year, and adjusted EBITDA exceeded $2 billion. GBV (Gross Book Value) increased by 14% year-over-year, and Nights and Seats Booked increased by 9%. Both metrics showed accelerated growth compared to the second quarter, primarily driven by growth in the U.S. market and the performance of average nightly rate (ADR).

Airbnb co-founder and CEO Brian Chesky stated that the third quarter was one of the company's strongest quarters ever, with record profits. The company will accelerate the deep integration of artificial intelligence with Airbnb in the future.

Honda Motor Operating profit for the first half of the fiscal year decreased by 41% year-on-year.

On November 7, Honda Motor Co., Ltd. released its financial results for the first half of fiscal year 2026, ending September 30, 2025. The report showed that operating profit for the first half of the fiscal year was 438.144 billion yen, a decrease of 41.0% year-on-year; profit attributable to owners of the parent company was 311.829 billion yen, a decrease of 37.0% year-on-year. Honda expects operating profit for the full fiscal year to decrease by 54.7% year-on-year to 550 billion yen, and profit attributable to owners of the parent company to decrease by 64.1% year-on-year to 300 billion yen.

TSMC plans to issue NT$23.5 billion in bonds with a 5-year maturity and a 1.5% interest rate.

On November 7, TSMC announced that it will issue its fifth tranche of unsecured ordinary corporate bonds this year, totaling NT$23.5 billion, which are green bonds. The tranche includes NT$14 billion of 5-year bonds with an interest rate of 1.5%; NT$3 billion of 7-year bonds with an interest rate of 1.53%; and NT$6.5 billion of 10-year bonds with an interest rate of 1.58%.

Ford Motor Company It is reported that production of the electric version of the F-150 pickup truck is being considered for discontinuation.

Reports indicate that Ford executives are actively discussing abandoning the electric F-150 pickup truck. Ford once touted the F-150 Lightning as a "modern Model T" to highlight its importance to the company, but its performance has fallen far short of expectations due to a lack of interest from U.S. truck buyers in the electric version of its best-selling truck. Since 2023, Ford has accumulated $13 billion in losses in its electric vehicle business.

Key events to watch in the US stock market (Beijing time)

November 7

23:00 US November 1-year inflation rate expectations (preliminary), US November University of Michigan consumer sentiment index (preliminary)

November 8

00:00 US October New York Fed 1-year inflation expectations

04:00 Federal Reserve Governor Milan speaks on "Stablecoins and Monetary Policy"

(Article source: CLS)