Former U.S. House Speaker Nancy Pelosi announced last week that she will not seek re-election after completing her current term in January 2027, ending her four-decade-long congressional career. The San Francisco politician is best known for becoming the first woman to wield the speaker's gavel and has also been the subject of much controversy for her remarkable stock market gains.

According to Quiver Quantitative, Pelosi and her husband made over $130 million through stock trading during Pelosi's 38 years in Congress—a return of 16,930%. In comparison, the Dow Jones Industrial Average rose 2,300% during the same period. The Pelosi family's current assets are approximately $280 million, compared to about $3 million when she first entered Congress.

Kirsten Pell's statement, a spokesman for the Republican National Committee, said: "Nancy Pelosi's real 'legacy' is becoming the most successful insider trader in American history. If it were anyone else who could turn $785,000 into $133.7 million and make more money than Buffett, they would probably be in jail by now."

Becoming a billionaire through stock trading

The return on investment reached 16930%.

Before Pelosi first took office as a U.S. Congressman in 1987, she and her husband, Paul Pelosi, held U.S. stock worth between $610,000 and $785,000, including shares in Citigroup. And the stocks of many companies that are no longer publicly traded.

According to Quiver Quantitative estimates, the Pelosi couple's investment portfolio is currently worth $133.7 million. This means that since Pelosi entered the U.S. Congress, the couple's investment return has reached an astonishing 16,930%, nearly seven times the Dow Jones Industrial Average's increase (2,300%) during the same period.

Over the past decade, the Pelosi couple's investment returns have also been astonishing, with an estimated cumulative return of 838%, nearly double that of the S&P 500 index (256%) during the same period. Data also shows that Pelosi achieved a 70.9% profit in 2024 alone, more than double the S&P 500 index's 25% gain last year, and exceeding the returns of most large hedge funds.

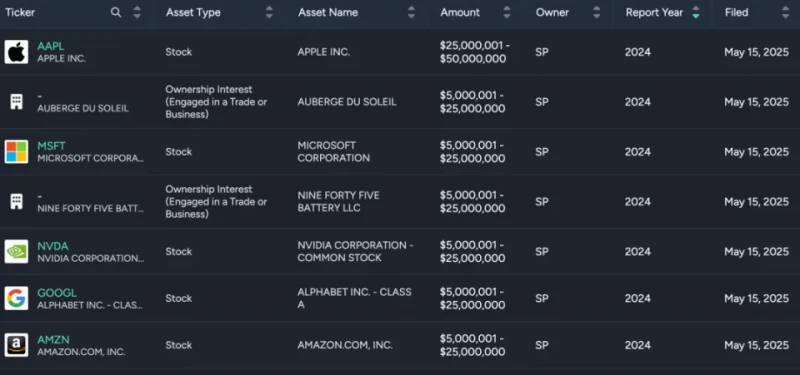

Pelosi's 2024 financial disclosure report showed that she held approximately 24 stocks at the time, including Nvidia. Salesforce, Netflix , apple Among her holdings are companies like Apple , which is her largest stock holding, valued at between $25 million and $50 million.

It's worth noting that Apple 's market capitalization surpassed $4 trillion for the first time on October 28, following Microsoft. Apple and Nvidia have broken this stock market milestone for the first time this year. As of the close of trading on November 7, Apple's stock price fell 0.48% to $268.47, with a market capitalization of $3.97 trillion, up more than 37% over the past six months.

US chipmaker Nvidia leverages artificial intelligence Dongfeng Motors became the first publicly traded company to surpass a market capitalization of $4 trillion in July. Meanwhile, Nvidia's market capitalization briefly surpassed $5 trillion on October 29th, becoming the world's first company to reach this milestone, driven by a renewed surge in artificial intelligence on Wall Street. As of the closing bell on November 7th, Nvidia's stock price rose 0.04% to $188.15, with a market capitalization of $4.57 trillion, representing a more than 99% increase over the past seven months.

Later that month, as Nvidia surpassed the $4 trillion mark, Microsoft announced strong fourth-quarter revenue, briefly pushing its market capitalization above $4 trillion. Subsequently, the company's stock price fell. However, on October 28, the Open AI Research Center announced a restructuring, valuing Microsoft 's 27% stake at $135 billion, propelling Microsoft's market capitalization to a new high of slightly over $4 trillion. As of the close of trading on November 7, Microsoft's stock price fell 0.06% to $496.82, with a latest market capitalization of $3.69 trillion, representing a more than 15% increase over the past six months.

According to the filing, in addition to stocks, the Pelosi family has invested in other businesses, including a winery valued at between $5 million and $25 million, an Italian restaurant, some commercial real estate, and a political data and consulting firm.

Some have attempted to directly replicate Pelosi's trading strategy. Dan Weiskopf, portfolio manager of the NANC exchange-traded fund that tracks Pelosi's holdings, said that after Pelosi's retirement, he believes he will miss her trading strategy the most.

Weiskopf emphasized that Pelosi and others trade with high confidence and a high degree of aggression, the only reason being that their trades are not based on technical analysis, but rather on their knowledge of the companies involved and a trading process that gives them confidence.

He added that Pelosi's trading style involves heavy use of options to leverage her position and investing large sums of money. Throughout this process, he did not observe any panic or inconsistency in her trading activities.

The infamous "Capitol Hill stock market guru"

There is widespread skepticism in American society regarding Nancy Pelosi, the "Capitol Hill stock market guru," with a growing number of people demanding a ban on members of Congress and their spouses trading individual stocks, because these lawmakers are said to know key information affecting the US stock market earlier than ordinary investors.

In April, U.S. President Donald Trump said he would "absolutely" sign a bill banning members of Congress from trading stocks, citing concerns that lawmakers could use insider information to gain an advantage. "I have no problem with that," Trump said in a Time magazine interview published Friday. "If they send the bill to me, I'll sign it."

For a long time, both parties have supported legislation to restrict members of Congress from buying and selling stocks because they have access to classified intelligence and inside information about the legislative process, giving them an advantage over others in the market.

In 2020, a group of bipartisan senators faced criticism for trading healthcare stocks after closed-door briefings on the COVID-19 pandemic. Trump specifically criticized former House Speaker Nancy Pelosi, who, during her tenure, opposed legislation banning members of Congress and their families from trading stocks. Pelosi's husband, Paul Pelosi, amassed his wealth in the San Francisco area through real estate and venture capital, and critics often cite the couple's substantial returns from stock trading as an example.

Throughout Trump's first term, Pelosi was a major opponent of him and spearheaded his impeachment. She also described herself as a "cold-blooded reptile." Pelosi has been and remains a staunch supporter of Israel. She even called on the FBI to investigate pacifists who support a peaceful resolution to the Palestinian conflict. After Russia launched its special military operation in Ukraine, Pelosi wanted Moscow to experience the "pain" of Western sanctions and threatened to designate Russia as a state sponsor of terrorism. Furthermore, she proposed using frozen Russian assets to rebuild Ukraine.

In July of this year, a bill co-introduced by Republican Senator Josh Hawley, which would have prohibited members of Congress, as well as the president and vice president, from trading stocks while in office, passed its first hurdle in Congress: it was approved by the Senate Homeland Security and Governmental Affairs Committee by a vote of 8 to 7.

In a joint statement, Hawley said the bill, titled the Honesty Act, would prohibit members of Congress, the president, vice president, and their spouses from holding and trading stocks. It's worth noting that the bill was originally titled "Preventing Elected Officials from Holding Securities." The "Pelosi Investment Act" (also known as the Pelosi Act) was a bill that had drawn considerable criticism due to the high returns of former House Speaker Nancy Pelosi and her husband from stock trading. However, in order to secure the support of Democratic senators on the committee, Hawley agreed to rename the bill.

On July 30, Trump posted on social media that Hawley was a "second-rate senator." Hawley responded that Trump's dissatisfaction stemmed from a misunderstanding of the bill's content.

Hawley's initial proposal required officials, including the president and vice president, and members of Congress to divest from all investments they were involved in, starting in March 2027. However, the version that was ultimately approved that day provided a grace period, stipulating that the provision would only apply from the start of these officials' next term— meaning that the bill is highly unlikely to apply to Trump.

(Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors should make their own decisions and bear their own risks.)

(Article source: Upstream News)