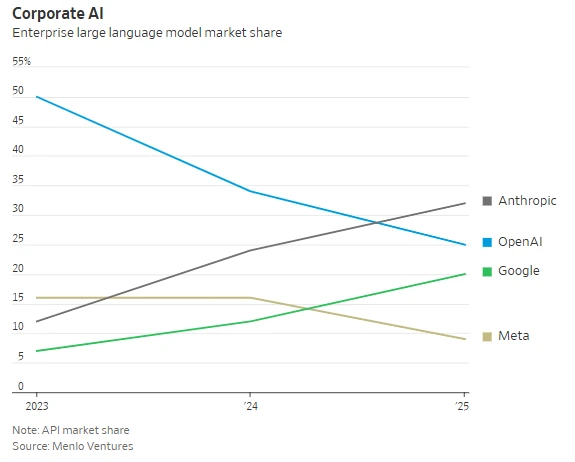

① The world's two most valuable AI startups are adopting drastically different business growth strategies; ② OpenAI expects its sales profit margin to be lower than Anthropic's over the next five years, but it has advantages in chips and data centers. They have invested far more in AI technology infrastructure than the latter, and are trying to attract top research talent through more generous stock option incentives.

Documents obtained by industry insiders reveal that Silicon Valley's two major artificial intelligence... The financial status of startups is revealing their drastically different development paths in the current AI boom: Anthropic is poised to become profitable faster than its competitor OpenAI.

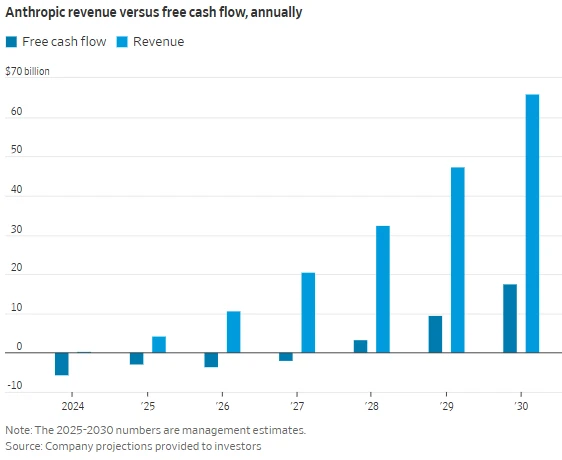

The documents show that, thanks to the Claude chatbot With its strong capabilities in areas such as programming, Anthropic continues to grow its number of enterprise users and is expected to achieve break-even for the first time in 2028.

In contrast, OpenAI, which is continuously increasing its cash burn, expects its operating losses to balloon to approximately $74 billion that year—equivalent to three-quarters of its revenue at that time, primarily due to soaring computing costs. OpenAI previously projected that its cash burn would be about 14 times that of Anthropic before it achieves profitability in 2030 (two years later than Anthropic).

The different approaches of the two AI giants

These two financial roadmaps, released to investors earlier this year, indicate that the world's two most valuable AI startups are pursuing drastically different business growth strategies. OpenAI expects its sales margin to be lower than Anthropic's over the next five years, but it invests far more in AI technology infrastructure such as chips and data centers , and is attempting to attract top research talent through more generous stock option incentives.

This ambitious plan also reflects OpenAI CEO Altman's grand vision: to transform OpenAI into a multi-trillion-dollar tech giant, dominate the pace of the AI wave, and demonstrate an almost limitless capacity for risk tolerance—a strategy that requires continuous funding to keep the startup afloat and could backfire if market confidence in AI technology or its profitability cools.

In fact, some investors recently sold off US tech giants due to concerns about whether AI spending and related infrastructure construction could generate sufficient revenue to support it.

The aforementioned financial data from OpenAI appears in the company's partnerships with multiple cloud computing companies. This comes before a series of new computing agreements are signed with chip giants—meaning its spending could rise further in the coming years. As Altman recently revealed on the X platform, these agreements require OpenAI to commit up to $1.4 trillion in spending over the next eight years, raising concerns among industry skeptics and some investors about its solvency.

In contrast, the documents show that Anthropic is taking a more cautious approach, with its cost growth rate more closely matching its revenue growth rate. The company is focused on increasing sales to enterprise customers (currently accounting for approximately 80% of its total revenue) and has avoided OpenAI's costly explorations in image and video generation—areas requiring significantly more computing power. Meanwhile, Anthropic's AI models are relatively more popular among programmers.

It's worth noting that Anthropic's founding itself has significant ties to OpenAI—the company was founded four years ago by former Google researcher Dario Amodei, who left OpenAI after a dispute with Altman. When ChatGPT went viral, the startup was initially caught off guard—the product gave OpenAI a massive user base and a significant sales lead.

However, Anthropic quickly shifted its focus to selling its Claude chatbot to enterprises, and its valuation recently climbed to $183 billion. OpenAI's current valuation is approximately $500 billion.

Which approach is better or worse?

Currently, almost all major investors in Silicon Valley hold shares in these two companies and are hoping to achieve the largest IPO in tech history. The world's three largest cloud service giants also closely link their growth to these two startups: Microsoft... Amazon is the largest cloud service provider for OpenAI. Google provides cloud support for Anthropic.

Private companies typically disclose rapidly growing revenue figures, but keep other financial information confidential—because these figures are usually far less impressive than revenue. This practice is particularly common among AI developers, who are reluctant to reveal their staggering cash burn rates. However, recently, some industry media outlets have disclosed certain financial metrics of two companies.

The documents show that OpenAI expects to burn through $9 billion in cash this year, with sales of $13 billion; Anthropic expects to burn through nearly $3 billion in cash on $4.2 billion in sales—both companies have cash burn rates of about 70% of their revenue.

However, Anthropic's operational efficiency will subsequently improve significantly. By 2026, Anthropic expects its cash burn rate to drop to about one-third of revenue, while OpenAI's burn rate will remain at 57% during the same period. In 2027, Anthropic's cash burn rate is expected to further decrease to 9%, while OpenAI's will remain unchanged.

Of course, the fact that OpenAI is still "burning money" even while Anthropic is profitable doesn't necessarily mean there's anything wrong with its current path. In fact, if product demand continues to surge, OpenAI's massive early investments (especially in new chips and data centers ) could yield substantial returns. The company recently launched the highly successful video application Sora and the browser Atlas, and is actively developing new consumer hardware devices, ChatGPT e-commerce advertising capabilities, and humanoid robots .

An OpenAI spokesperson recently stated, "The current demand for artificial intelligence exceeds the supply capacity of existing computing resources. Every dollar we invest in AI infrastructure is going towards serving hundreds of millions of consumers, businesses, and developers who rely on ChatGPT to improve their productivity."

The documents show that the company is investing nearly $100 billion to expand its data center backup capacity to cope with potential unforeseen demands from future products and research. The computing power it has reserved for new artificial intelligence research far exceeds that of Anthropic.

Altman also recently published an article on the X platform, stating, "We believe that OpenAI faces a far greater and more likely risk of insufficient computing power than the risk of excess computing power."

(Article source: CLS)