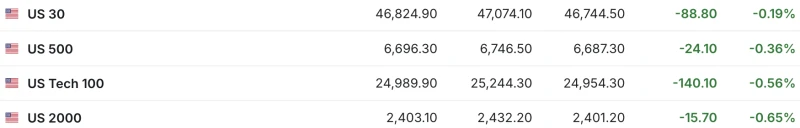

On November 11 local time, the three major U.S. stock indexes closed mixed, with the Dow Jones Industrial Average up 1.18%, the S&P 500 up 0.21%, and the Nasdaq Composite up 0.21%. The composite index fell 0.25%.

Chip stocks generally fell, with Micron Technology among the decliners. ARM fell more than 4%, Nvidia fell more than 3%. AMD, Applied Materials Apple fell more than 2%. Major tech stocks were mixed, with Apple among the decliners. Netflix rose more than 2%. Oracle rose more than 1%. Tesla fell more than 2%. It fell by more than 1%.

Among them, Nvidia's market value evaporated by $143.127 billion (approximately RMB1,018.678 billion) overnight.

On November 11th local time, at AMD's first-ever Corporate Financial Analyst Day event, AMD CEO Lisa Su gave an optimistic outlook on artificial intelligence. The AI market anticipates and expects AMD's sales to accelerate over the next five years.

Lisa Su stated that AMD anticipates that by 2030, AI data centers , including processors, accelerators, and networking products, will... The total market size (TAM) will exceed $1 trillion, far surpassing this year's approximately $200 billion, with a compound annual growth rate (CAGR) of over 40%. In June of this year, Lisa Su stated that the market size of AI processors is expected to exceed $500 billion by 2028.

Lisa Su revealed that AMD expects its annual revenue CAGR to exceed 35% over the next three to five years, with AI data center revenue growing by an average of 80%. In comparison, analysts currently expect AMD's annual sales to grow by an average of 32% this year, followed by 31% and 39% in 2026 and 2027, respectively.

During Lisa Su's speech, AMD's stock price, which had fallen more than 3.8% when it hit a daily low in the midday session, rallied and rose as much as 2% during the session, but the gains could not be maintained and it subsequently resumed its downward trend. However, in after-hours trading, AMD's stock price rose more than 3%.

AI tech stock CoreWeave saw its shares plummet by over 16% after the company lowered its full-year revenue forecast. This downward revision of guidance dealt a blow to the company racing ahead in the AI boom. (JPMorgan Chase) We downgraded its rating from "overweight" to "neutral".

Popular Chinese concept stocks showed mixed performance, with the Nasdaq China Golden Dragon Index closing down 0.06%, and XPeng Motors... NetEase rose more than 7%. Li Auto Alibaba rose more than 1%. Bilibili fell more than 3%. NIO It fell by more than 1%.

Jiuzhou Pharmacy rose 73.81%, Dingxin Holdings rose 35.04%, and Huami Technology rose 4.5%. It rose by 18.62%.

The FTSE A50 futures index closed up 0.07% in overnight trading, at 15,354 points.

International oil prices rose on November 11. At the close of trading that day, the price of light sweet crude oil futures for December delivery on the New York Mercantile Exchange rose 91 cents to settle at $61.04 per barrel, an increase of 1.51%; the price of Brent crude oil futures for January delivery on the London ICE Futures Exchange rose $1.10 to settle at $65.16 per barrel, an increase of 1.72%.

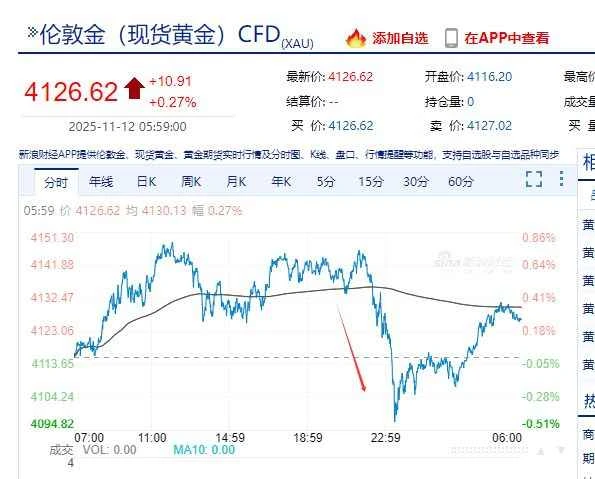

Spot gold briefly fell below the $4,100 mark during the session.

Bitcoin fell by more than 3%. Data shows that in the past 24 hours, a total of 151,465 people across the cryptocurrency network were liquidated, with a total liquidation amount of $511 million (approximately RMB 3.6 billion).

On November 11 local time, US President Trump warned that if the US Supreme Court rules against the legality of its massive tariffs, it will cause losses of more than $3 trillion, and the US will face a major economic and national security crisis.

According to a Reuters report cited by CCTV News, Trump stated on social media on the 11th that if the Supreme Court issues an unfavorable ruling to repeal the tariffs, it would trigger tariff refunds exceeding $3 trillion. He said that such a massive blow would be irreparable, triggering an unmanageable national security crisis and causing a "devastating blow" to the future of the United States.

On November 5th local time, the U.S. Supreme Court held a hearing on the legality of the Trump administration's tariff policies, hearing related arguments. The core issues in the lawsuit included the Trump administration's invocation of the 1977 International Emergency Economic Powers Act to establish a 10% "minimum benchmark tariff" on trading partners, and imposing higher tariffs on certain trading partners. The oral arguments lasted approximately two and a half hours.

Daily Economic News, based on CCTV News and publicly available market data

(Source: Daily Economic News)