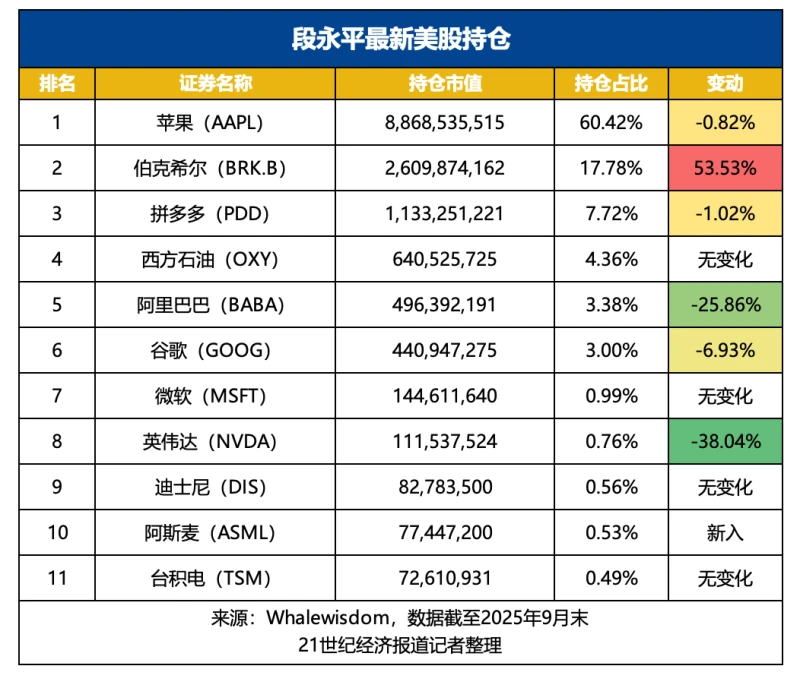

Recently, H&H International Investment, the entity through which Duan Yongping holds US stocks, disclosed its latest 13F filing.

According to Whalewisdom, as of the end of the third quarter of this year, the total market value of this portfolio was approximately $14.679 billion, an increase of about 28% compared to the previous quarter. The top ten holdings accounted for a staggering 99.51% of the portfolio, with Apple being a prominent example. The company remains the largest holding.

In the third quarter, Duan Yongping became a new lithography machine giant ASML. Berkshire Hathaway significantly increased its stake; Alibaba and Nvidia The company significantly reduced its holdings, by more than 25%, and also slightly reduced its holdings in Apple and Pinduoduo. Google.

On November 11th, the program released a new interview with Duan Yongping (interview date: October 16, 2025). In the program, Duan Yongping, who has been "retired" for over 20 years, answered questions about his investment philosophy, major investment cases, business management, technological development, and education. The program featured a series of questions on topics such as investment philosophy and personal growth. It quickly went viral within investment circles, becoming a rare window for the market to understand the program's investment approach.

During the hours-long conversation, Duan Yongping displayed his usual candor, sharpness, and directness.

For the first time, he systematically reviewed his few major holdings, such as Kweichow Moutai, Tencent, and Apple , and made no secret of his appreciation for their business models. At the same time, he also frankly admitted his judgments in past investments. For example, although investing in General Electric was ultimately profitable, he still regarded it as a "wrong" decision because the company did not meet his two core stock selection criteria of "business model" and "corporate culture".

He also revealed that he had considered selling when Moutai's stock price reached 2,600-2,700 yuan, but ultimately chose to continue holding and even increase his position based on considerations of "opportunity cost." He remained calm about the subsequent halving of Moutai's stock price and reiterated his principle: "If you can't accept a 50% drop in a stock, you shouldn't buy it."

When evaluating individuals, he acknowledged Musk's abilities but bluntly stated his dislike for his personal character, saying, "Investing in a company is about being friends with the other party, and I don't want to be friends with Musk." Conversely, he praised Nvidia founder Jensen Huang, admiring his strategic resolve—"What he said more than ten years ago is the same today," and revealed that he had also bought Nvidia stock, not wanting to miss out on the opportunities of the AI era.

He elaborated on his core investment philosophy, "Buying stocks is buying companies," pointing out that the key premise is "understanding" the company, and that understanding a company itself is "very difficult," thus making "investing simple but not easy." He did not shy away from acknowledging his own cognitive limitations, admitting that he still does not fully understand General Electric and Google, and stating that his early investment in Pinduoduo was "a haphazard investment."

Based on this, he explicitly advised investors who were trying to "copy the homework" to stop this behavior, emphasizing that this method is unsustainable due to information lag and misunderstandings, and reiterated that "it is difficult to invest in companies you don't understand, so it's best to stay away."

Regarding business operations, he reiterated the principle of "finding the right people and doing the right things," and shared specific practices including focusing on differentiated products, adhering to user orientation, and "not following the list."

Throughout the dialogue, Duan Yongping, with his philosophical style, articulated the complex truths of investment and management in a remarkably straightforward manner. As he said, "Investing is simple but not easy," and each of his seemingly simple viewpoints is worth careful consideration by investors.

The 21st Century Business Herald reporter condensed this dialogue into 60 insightful quotes for readers.

The fundamentals of running a business: Do the right thing, find the right people.

1. Drucker's saying, "Do the right thing and do things right," resonated deeply with me. Taking five seconds to reflect on this statement before acting can save you a lifetime of trouble. In our company, when discussing the profitability of a business deal, we consider, "Is this the right thing to do?" Focusing solely on profit complicates matters.

2. We have a list of things we won't do, such as not doing OEM manufacturing. OEM manufacturing can be profitable, but we're not good at it.

3. Finding people with shared values relies primarily on selection rather than cultivation. Finding the right people also takes time. (Because) there are two scenarios: one is gradually weeding out the wrong people and keeping those who share the same values; the other is finding like-minded individuals who, after identifying with the company culture, will gradually follow you.

4. Our company empowers the CEO to make decisions and bear the consequences; I only act as an advisor.

5. Nokia They focused too much on market share and prioritized business over users, which caused them to miss opportunities, including the Google opportunity. Management can't save a company; their strategy and culture were flawed.

6. I did very well at Subor, but I left due to issues with the shareholding system. I didn't leave because of financial reasons, but because of trust issues; without a sense of contractual obligation, there is no credibility.

7. When we transitioned from feature phones to smartphones, we weren't sensitive enough and didn't expect sales to drop so quickly. Based on past experience, we thought it would decline gradually, but it happened in an instant.

8. More than 30 years ago, I said that UMC could not compete with TSMC. Because TSMC focuses on foundry services, while UMC not only manufactures its own chips but also develops a wide variety of other products. Unfortunately, this prediction came true; the two companies are now worlds apart.

Investing is simple but not easy

9. The premise of investing is that you understand the business. If you invest in a business that you don't understand, you will be in big trouble.

10. Buying stocks is buying a company, but the next step is understanding the company. Investing is simple yet not easy. It's simple because you need to understand the business and its future cash flow; it's difficult because it's hard to do that—most companies are not easy to understand. But even those who can't understand a company can still make money.

11. Buffett's concept of margin of safety doesn't refer to how cheap a company is, but rather how well you understand it. Cheap things can become even cheaper. I sold my NetEase shares. That means I didn't understand it that well back then.

12. Apple has a great corporate culture. They care a lot about making good products, about user experience, and they think very far ahead. They won't make something, no matter how popular, if they can't provide enough value to users.

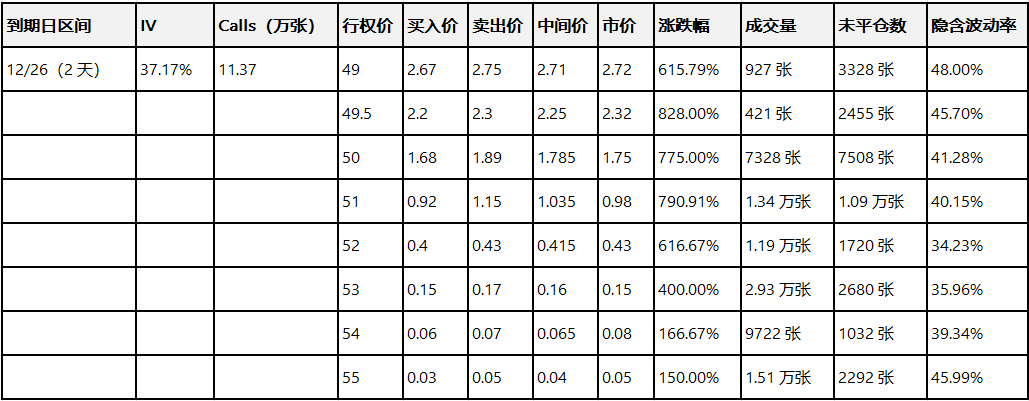

13. Apple's inability to produce electric cars isn't due to technical problems, but rather because when it finds that a product cannot add enough value to users and lacks sufficient differentiation, Apple simply stops pursuing it. They don't do things just for the sake of making money.

14. Apple (it may make mistakes, but its) culture is good; it's like it has a North Star guiding it, rather than just focusing on business. This ensures that even if it makes mistakes, it will eventually get back on track.

15. (General Electric) I used to like their corporate culture; they said, "Times change, but integrity remains constant." But later I couldn't find that quote on their homepage, so I decided to sell. I felt they no longer emphasized this point, and I genuinely couldn't understand their business model; they've bought and sold too many companies.

16. I tend to invest in companies I understand, ensuring that the money they earn in the future matches my opportunity cost.

17. Investment decisions are not determined by the price-to-earnings ratio, but by future cash flows.

Gains and Losses of Classic Cases

18. Making mistakes can sometimes make money. I made money buying General Electric, but I think it was a mistake because it didn't fit my "corporate culture and business model" filter, and I wouldn't buy it today.

19. My own major holdings started with NetEase , then Yahoo (to buy Alibaba), followed by Apple, Kweichow Moutai, and Tencent. I also invested in General Electric, but quickly exited after they changed CEOs. I usually tell people I only hold three stocks: Apple, Tencent, and Kweichow Moutai, and that's pretty much true. In the A-share market, I only bought Kweichow Moutai.

20. My initial investment in General Electric was influenced by Jack Welch; I thought the company was amazing. Later, I realized that no one is truly amazing. When I sold, the market value was over $400 billion. I held it for about two or three years, not too long.

21. I invested in Pinduoduo in its early stages, a small amount, but I made a lot of money. Strictly speaking, it wasn't a large investment, because I invested rather haphazardly.

22. I used to buy oil and gas indexes because of a friend. I invested nearly 100 million US dollars, but lost more than 10 million US dollars.

23. Nvidia is indeed very powerful, with a very strong ecosystem. Just look at its collaboration with OpenAI, and then look at AMD's collaboration with OpenAI, and you can see how strong Nvidia is.

24. Everyone wants to use other chips now because of fear of Nvidia's monopoly and prices. Everyone hopes another company will emerge, because of the semiconductor industry . Once products become homogenized, prices will come down. But (currently) that's not possible.

25. I've watched many of Huang Renxun's videos; I admire him a lot. What he said more than ten years ago is the same as it is today; he saw that trend long ago and has been working towards it ever since. I think I should invest a little and see how it goes; at least get involved in AI, don't miss out.

26. Now it's clear that with the semiconductor and AI sectors taking off, no one can escape TSMC's influence . I also bought some, but the price has recently skyrocketed. Outrageous as it may be, it's not that expensive. If future developments are truly as Huang Renxun predicted, then the current price makes sense.

27. I made over 90% profit on Apple at its peak, buying every time it dipped. I've sold some now because I sell some call options; when it goes up, I just call them out. Once they're gone, I can buy other things.

28. Innovation should be based on user needs. Change only if needed, don't change if not. Moutai's flavor is already established; trying to change it would be idiotic. Coca-Cola... We will develop new flavors, but the original flavors will be retained.

29. I've always liked Google, but I just don't understand it. Now I'm starting to worry about how much AI will replace the search business; I don't know. But overall, the company is pretty good, so I bought some shares recently.

30. The electric vehicle business isn't doing well; it's exhausting, and there's little differentiation. But Tesla... By differentiating itself, it offers fewer styles, a single product line, and a large production volume. Because of its relatively low cost, it is likely to be profitable.

31. Musk is indeed impressive, with many advanced ideas. However, I think investing in him would be difficult, as I personally don't like his character. Investing is essentially about being friends with him, and I don't want to be friends with him.

32. My investment in Pinduoduo is still venture capital, and I wouldn't recommend others to buy it. It's cheap if it can sustain the business, but I don't know if it can truly do so. I trust their culture and team, but I don't know about the broader environment.

Apple will definitely be doing very well in 33.5-10 years, but I'm not so clear about Pinduoduo.

34. Talking about Moutai to someone who doesn't drink is like trying to explain the joys of travel to a fish—it's impossible to explain. People who enjoy Moutai will continue to drink it as long as they can afford it, and Moutai maintains strict standards regarding its most basic quality, which gives me peace of mind.

35. When Moutai was at 2600 yuan, I really wanted to sell, but my biggest hesitation was what to buy afterward? Looking around, I couldn't bring myself to buy anything. I'm a committed investor; I shouldn't buy if the stock price drops by 50%. I knew Moutai would eventually recover, so I kept buying it whenever I had spare cash.

36. I used to think semiconductors were too difficult to work in, so I didn't get involved, which was a major reason why I missed out on Nvidia. It wasn't until AI took off and I started paying close attention that I realized this company is really interesting and doesn't seem like something that's just been hyped up.

Protect the "Don't Do" List

37. The probability of making mistakes is roughly the same for everyone; the key is whether you have a "don't do" list. For the past thirty years, we've made fewer mistakes than others. People care about what we've done, but a significant reason we are who we are is because of the things we don't do. Doing the right things increases the probability. A small difference can make a huge difference over thirty years.

38. Learning comes at a price; making mistakes is acceptable in the process of doing the right thing. Over decades of accumulation, you will make far fewer mistakes and won't stagnate.

39. Electric vehicles have a simpler structure than gasoline vehicles, inevitably leading to a price war. Without sufficient differentiation, high profits are difficult to achieve, and most electric vehicle companies will fail. Only the last few remaining will be profitable. I don't know who will survive.

40. I don't quite understand why we need humanoid robots. Because whether a robot is humanoid or not is not important.

41. Investing is about selling. Many people have a big misconception about value investing: that holding long-term is the same as never selling. Holding long-term is just an intention when buying, but you always have to calculate your opportunity cost. If I had understood Nvidia five years ago, and only had Moutai in my portfolio, I would have had no reason not to switch.

42. The premise of switching positions is that you understand a better target. If you don't understand it, then it has nothing to do with you.

43. Investing in Moutai doesn't require considering the macroeconomic environment, because investment is about looking at a ten- or twenty-year timeframe. If the macroeconomic environment remains unfavorable, other investments will also suffer losses. Moutai's current dividend income is definitely higher than that of a bank deposit. Well, it's better than losing money elsewhere. It could very well drop further, but if you have the money, you can keep buying.

44. Investing is investing, and it has nothing to do with who you are. If you don't understand it, don't touch it. It's very difficult to make money in the stock market. Most retail investors lose money in both bull and bear markets. Don't think you're the special one. If you really know how to invest, you don't need advice. Just buy companies you think are good and hold them, comparing your opportunity cost.

Advice for ordinary people

45. Here's a way to make money: buy the S&P 500 index. Making money every time doesn't mean you understand it, but if you actually do it, it means you do understand it.

46. Not all indices are suitable for investment. Buffett recommends that ordinary people buy the S&P 500, not all indices. Alternatively, the Nasdaq could also be a good option. The 100 index is also acceptable.

47. Apple products aren't cheap right now, so I don't have high expectations for their return on investment. Of course, it also depends on opportunity cost. If you're just putting your money in the bank and getting a little over a percent in interest, then it's really better to buy Apple products; if you can find an opportunity to earn ten or more percent a year, then there's no need to buy Apple products.

48. The investment method of "copying homework" is difficult to sustain because it is lagging. My holdings are not public; no one else knows how much I've bought. Sometimes buying is just to force myself to take a closer look; if you go all in, you're making a mistake. Investing in companies you don't understand is very difficult; it's best to avoid it altogether.

49. (Even if Buffett retires) Berkshire Hathaway's culture will not change, and it will not become a speculative company. If you don't understand investing, you should buy a company like Berkshire Hathaway or the S&P 500 index; it's better than buying mutual funds and saves you a lot of trouble.

50. AI is definitely an industrial revolution, but bubbles always come along. It will certainly bring about significant changes, but I don't fully understand it yet. However, AI still can't replace investing. AI doesn't affect my investment decisions, but it will make it harder for those who rely on charts and charts for short-term trading to make money.

51. Few people understand the statement that "buying stocks is buying a company." The real buyer of a company is the company itself; it buys itself back based on its profits, just like Moutai buying back its own shares when they were cheap. Moutai should have done so long ago.

52. AI will increase GDP, but it will also reduce staff in some areas; some people will definitely be replaced. Everyone should take this seriously. Don't say you can't learn it. If I can learn it, why can't you? Many people stop accepting new things after their forties, and that makes life very painful. Actually, new things can be quite fun sometimes.

Educational Reflections: Upholding Love and Boundaries

53. I don't ask my children to do things I can't do myself. But setting boundaries is very important; you must tell them what they can't do. It's crucial to give children a sense of security; without security, it's difficult for a person to be rational.

54. Everything parents do is to increase their children's sense of security. Conversely, things that reduce a child's sense of security should not be done, such as hitting or scolding the child.

55. Children raised through discipline might be more filial, but that's just fear, and it's actually bad for their lifelong development. They'll be unhappy, and people who love their children shouldn't do that. Of course, this doesn't mean you can spoil your child without principles, giving them whatever they want. Boundaries are hard to define, but it really takes effort to establish them.

56. Everything parents do for their children is a way of teaching them how to do things. If you scold them, you are teaching them to swear; if you hit them, you are teaching them to hit children in the future; if you are nice to them, you are implying that they should be nice to others.

57. Children will always have tempers, and they will express their emotions verbally at certain times. For example, they might say, "I don't love you anymore," but that might just be a temporary mood swing. Don't take it seriously, don't confront them directly, try to distract them, and they might say "I love you" again after a while. The key is not to argue with your child.

58. The most important thing I learned in university was how to learn, which gave me confidence that I could learn things I didn't understand. This confidence is very important; it greatly reduces my fear of the future.

59. Education is certainly very useful, and learning ability is especially important. I was also a test-taker in a small town, but many people struggle with test-taking. The key is to find methods and the reasons behind mistakes in order to learn the overall logic.

60. I've never been an ambitious person; I just want to enjoy each day and do what I love. I can do well because I enjoy it, not because I've succeeded. It's the same with running a company. I find people I like to work with and let them do it, so I can go do other things I enjoy.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: 21st Century Business Herald)