As a valuation benchmark for global technology stocks, Nvidia They were thrust into the center of a media storm.

On November 21st, an article titled "The Algorithm That Exposes the $610 Billion Scam: How Machine Intelligence Exposes the Circular Financing Scam in the AI Industry" quickly circulated on global social media and in Chinese financial circles. Shortly after Nvidia released its impressive earnings report, its stock price plummeted, US tech stocks collectively weakened, and the A-share ChiNext market also fell sharply, raising three major concerns in the market: Was Nvidia's earnings report fabricated? Is the US tech "bubble" about to burst? Has the A-share tech rally peaked?

Did Nvidia "fake"?

This controversy stems from an article published by Shanaka Anslem Perera, an "independent researcher" active on American social media. He claims that the algorithm discovered "serious inconsistencies" in Nvidia's accounting data.

Specifically, this includes: accounts receivable reaching $33.4 billion in the company's latest financial report, a surge of 89% in one year, with extended collection cycles; inventory increasing by 32% to $19.8 billion, contradicting claims of a chip shortage; and a cash conversion rate of only 75%, far lower than that of the semiconductor industry. Industry standard level.

Meanwhile, the circular transactions among US AI giants have also raised concerns about the industry's genuine demand. "Currently, the AI industry's cash flow network is worth a staggering $610 billion," the article states. "This cycle works like this: Nvidia invests in AI technology companies, these companies commit to cloud service spending, cloud providers purchase Nvidia hardware, and Nvidia recognizes revenue. However, because the most fundamental economic activity—namely, profitable AI applications—remains insufficient, the cash flow is not completing a full cycle."

In response to the above questions, an analysis and verification report stated: "The above inferences are based on misinterpretation and taking things out of context. He maliciously interpreted the normal increase in operating capital of a tech giant in a period of rapid expansion (accounts receivable and inventory growing in tandem with revenue) as 'fake revenue' and 'fraud,' deliberately ignoring the common business sense of revenue expansion and inventory preparation for new products (Blackwell)."

Although Perera uses titles such as "system architect" and "AI expert" in his personal profile, investigations show that his core professional identity is "founder and CEO of Pet Express Sri Lanka".

The investigation report concluded that "Nvidia's stock price fluctuations after the earnings release, initially rising and then falling, are a common phenomenon during earnings season where the positive news has been fully priced in. To interpret this normal market dynamic as 'discovering fraud' is pure alarmism."

"The probability of Nvidia committing fraud is low, and there's no need for it to." Ma Kewei, Chairman of Mingze Investment, told China Securities Journal. The reporter stated, "From the perspective of the logical relationship of the financial data, it complies with accounting standards and has a positive impact on ecosystem building. Nvidia's current leading position is difficult to replace in the short to medium term, specifically reflected in its systematic capabilities in hardware production, as well as its market advantages in the AI market and 3D simulation field. Its long-term accumulated simulation data will provide support for the digital transformation of various industries, thereby solidifying the foundation of its financial valuation."

Behind the Decline: Policy and Liquidity in Harmony

Recently, global financial markets have experienced significant volatility. Goldman Sachs ... John Flood, a partner at the group, said that Thursday's dramatic reversal in the U.S. stock market indicates that Nvidia's strong earnings report failed to signal risk aversion to traders, instead prompting them to seek safe havens to prevent further losses. Currently, the market is uncertain about the Federal Reserve's ability to... There are doubts about whether interest rates will be cut, and concerns about overvaluation of tech stocks and technical factors, the latter of which could prompt continued short-term selling.

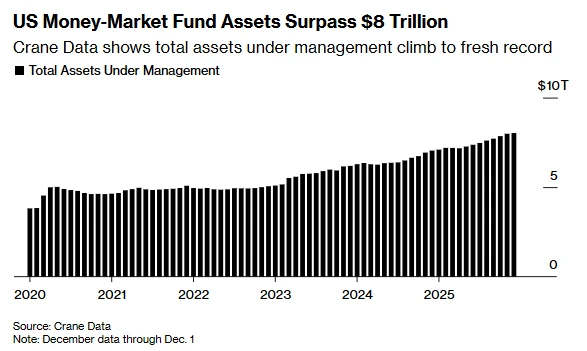

Some analysts also believe that the increasingly prominent short-term liquidity shortage, catalyzed by the Fed's hawkish signals, may be one of the major drivers behind the decline in technology stocks.

On November 20, U.S. time, Federal Reserve Governor Michael Barr stated that the current inflation rate remains above the 2% policy target, and "extreme caution must be exercised when considering further rate cuts." Subsequently, the CME Group's FedWatch tool showed that the market's expectation of a December rate cut plummeted to around 30%.

In terms of short-term liquidity, the Secured Overnight Financing Rate (SOFR), a core indicator for measuring the cost of short-term funding for the US dollar, has continued to rise recently. The spread between SOFR and the Federal Reserve Reserve Balance Rate (IORB) has widened significantly, indicating that liquidity in the financial system is shifting from "ample" to "scarce." Multiple factors have led to tight liquidity supply in risk markets such as the stock market.

However, the situation took a turn on Friday, local time in the United States. Before the market opened on November 21st, New York Federal Reserve President John Williams... The statement indicated that "given the current slightly tight policy environment, the Federal Reserve could still cut interest rates in the near future." This statement directly stimulated a recovery in market sentiment. However, some market analysts believe that funds will continue to gamble based on expectations of further rate cuts.

Has the tech sector peaked?

According to recent 13F filings from US stock market institutions, several top investment firms have withdrawn from high-priced tech stocks such as Nvidia. These include: Michael Burry, the "Big Short" architect; Peter Thiel, a legendary tech investor; Bridgewater Associates; SoftBank; UBS; and Barclays. Bank of America UBS Group Bank of Montreal HSBC Holdings Citigroup wait.

Recently, CICC Chief Economist Peng Wensheng commented on the "AI investment bubble controversy," stating that the current high valuations of AI-related stocks in the United States may have two causes: first, investors are overly optimistic about the long-term profit growth of AI, leading to a large discrepancy between stock prices and current earnings; second, the current earnings driven by capital expenditure are unsustainable.

"The catalysts for the bursting of the tech stock bubble may come from the following aspects: the economies of scale in the chip industry may break down technological barriers, leading to a decline in chip prices; the actual economic benefits of large AI models may fall short of expectations," Peng Wensheng said. "Although the bursting of the tech bubble will have a significant impact in the short term, it may be beneficial to long-term, macro-level technological progress and innovation."

On the evening of November 21, Morgan Stanley The fund commented on interest rate cut expectations and AI volatility, stating that the Federal Reserve's monetary policy is not expected to have a greater impact on future market trends. A December rate cut cannot be completely ruled out, and rate cut expectations may fluctuate. From a medium- to long-term perspective, the Fed's rate-cutting cycle has not ended. Regarding the balance between AI capital investment and output, the most pessimistic scenario is excessive capital investment, but as AI applications are continuously rolled out, a balance between input and output will be achieved. Furthermore, the long-term development trend of AI remains unchanged.

On the same day, AllianceBernstein stated that, regardless of the circumstances, the Federal Reserve will maintain a moderately accommodative monetary policy for the foreseeable future to address the risk of a slowdown in the US economy. For A-share investors, the Fed's moderate monetary policy will continue to drive capital inflows into emerging markets, and this structural trend remains unchanged.

AllianceBernstein believes that the current AI boom is fundamentally different from the tech bubble of 2000: most AI-related companies today have stable, profitable businesses, rather than being simply driven by hype. Despite market skepticism, strong capital expenditures and profit guidance from US tech giants indicate that the AI industry's momentum will continue.

(Source: China Securities Journal)